Volatility & Hedging Update

Equity Volatility & Hedging Update – December 2023

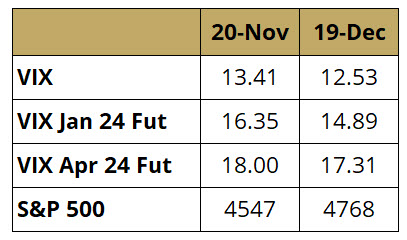

Table 1: Recent VIX History

VIX has remained anchored with the recent bullish trend in the equity market, where large cap US equities have rallied almost 5% over the last month. VIX remaining low has given futures contracts a nice opportunity to slide down the curve, as we can see for two representative parts of the curve in Table 1. During this past month, short VIX strategies gained handsomely, with the shorter end declining more.

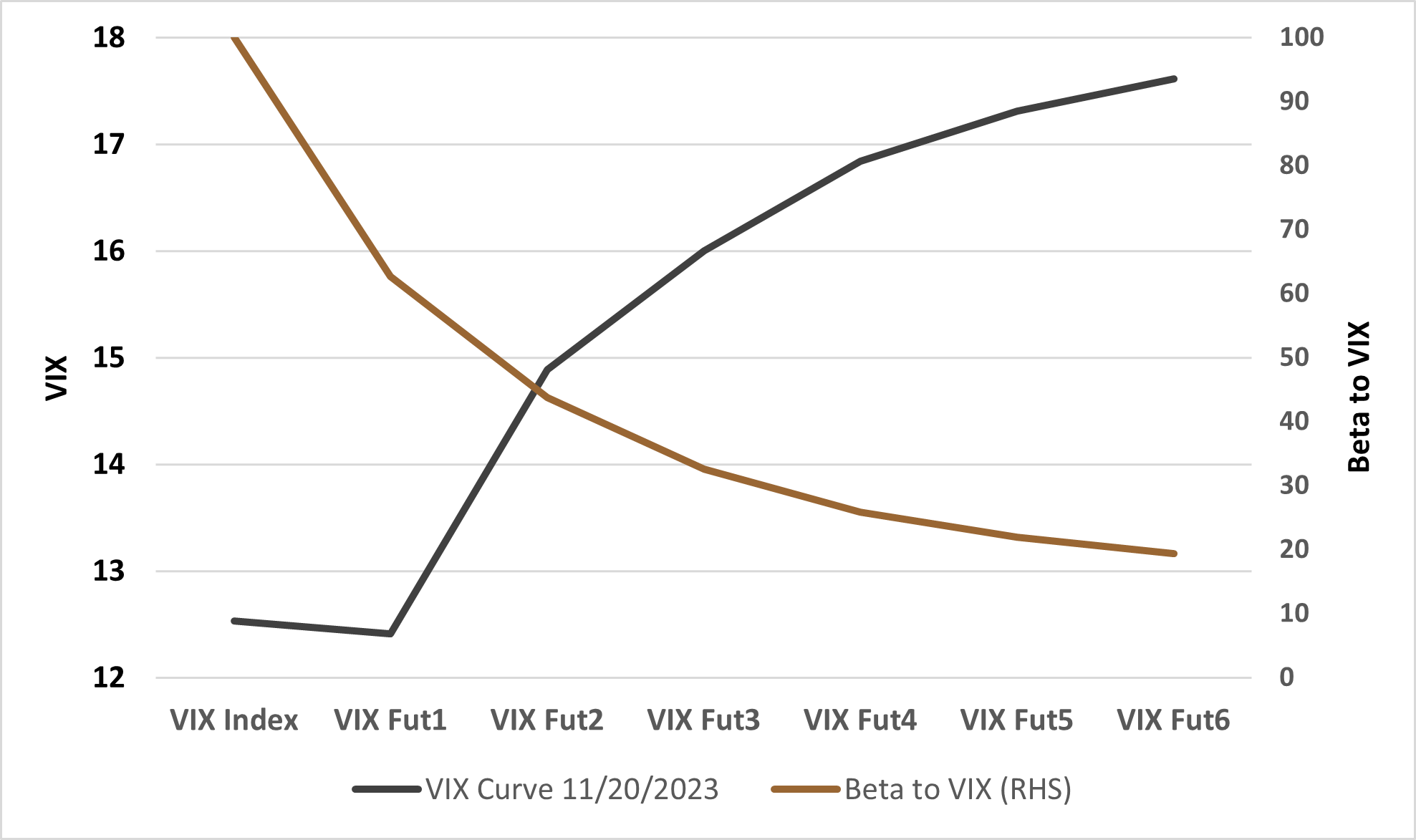

Low VIX is a result of not only improved risk sentiment, but also low levels of realized vol, which is potentially perpetrated by income strategies selling 0DTE options. Suppressed VIX has resulted in a steep VIX curve, with a healthy roll down across the curve, as illustrated in Figure 1. This chart also shows that long-dated VIX contracts have significantly lower beta to VIX. VIX is always vulnerable to a negative shock to risk sentiment, and more so when VIX is low, hence if one wants to short VIX in the current environment they should focus their efforts further out the curve to avoid excessive risk.

Figure 1: VIX Term Structure

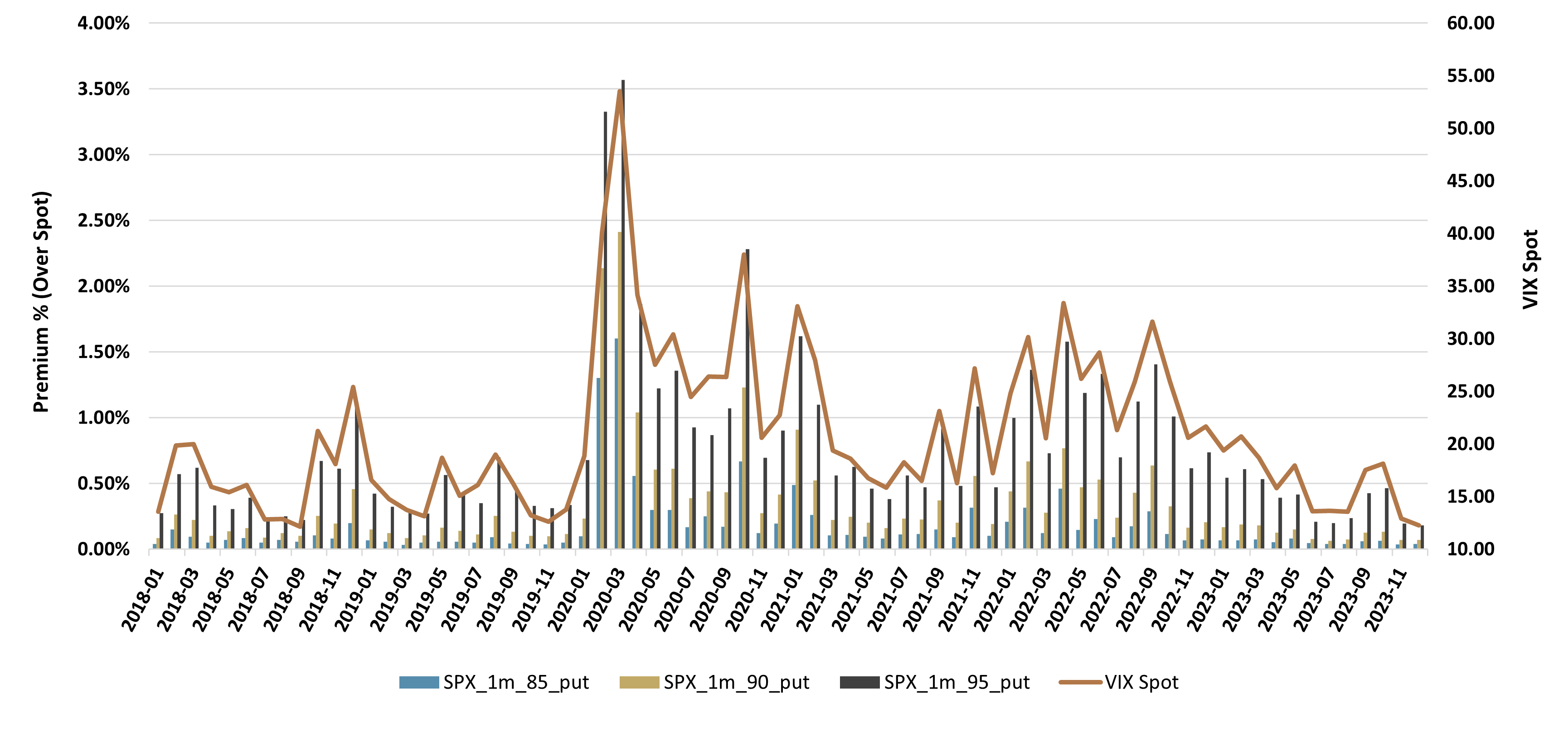

The continued move lower in VIX helped push SPX OTM put premia to their lowest levels since 2017, creating one of the cheapest 1-month 5% out-of-the-money downside protection costs of the last 15 years (see Figure 2).

Figure 2: Cost of 1-Month SPX Put Protection at

100% Notional (LHS) vs. VIX (RHS)

In this historical context, there are several factors worth mentioning when it comes to costless collar hedging strategies (i.e., long stock, long protective put, short call to fund the put): volatility skew and interest rates.

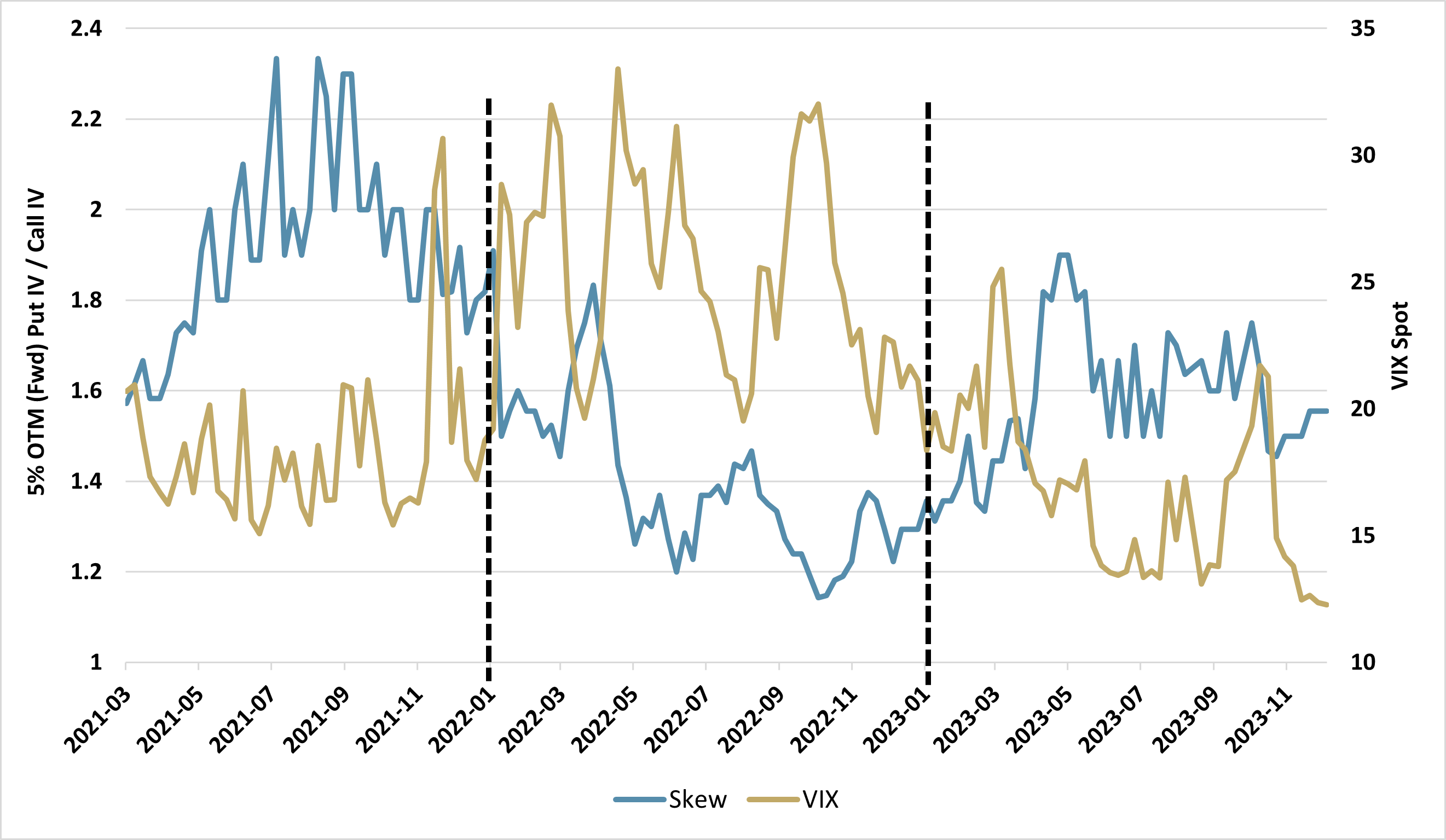

Figure 3 below compares VIX Spot with a simple measure of volatility skew (5% OTM Put IV / 5% OTM Call IV). In general terms, skew flattens as volatilities rise in an equity decline and steepens as implied volatilities come down after it (near the money volatilities fall first while further OTM strike volatilities remain sticky). As we will see next, a flatter volatility curve could theoretically favor the implementation of “zero-cost” collar hedging since out-of-the-money calls might become closer in price to their put counterparts, placing the upside cap at a higher level.

Figure 3: VIX Levels and 5% OTM Vol Skew

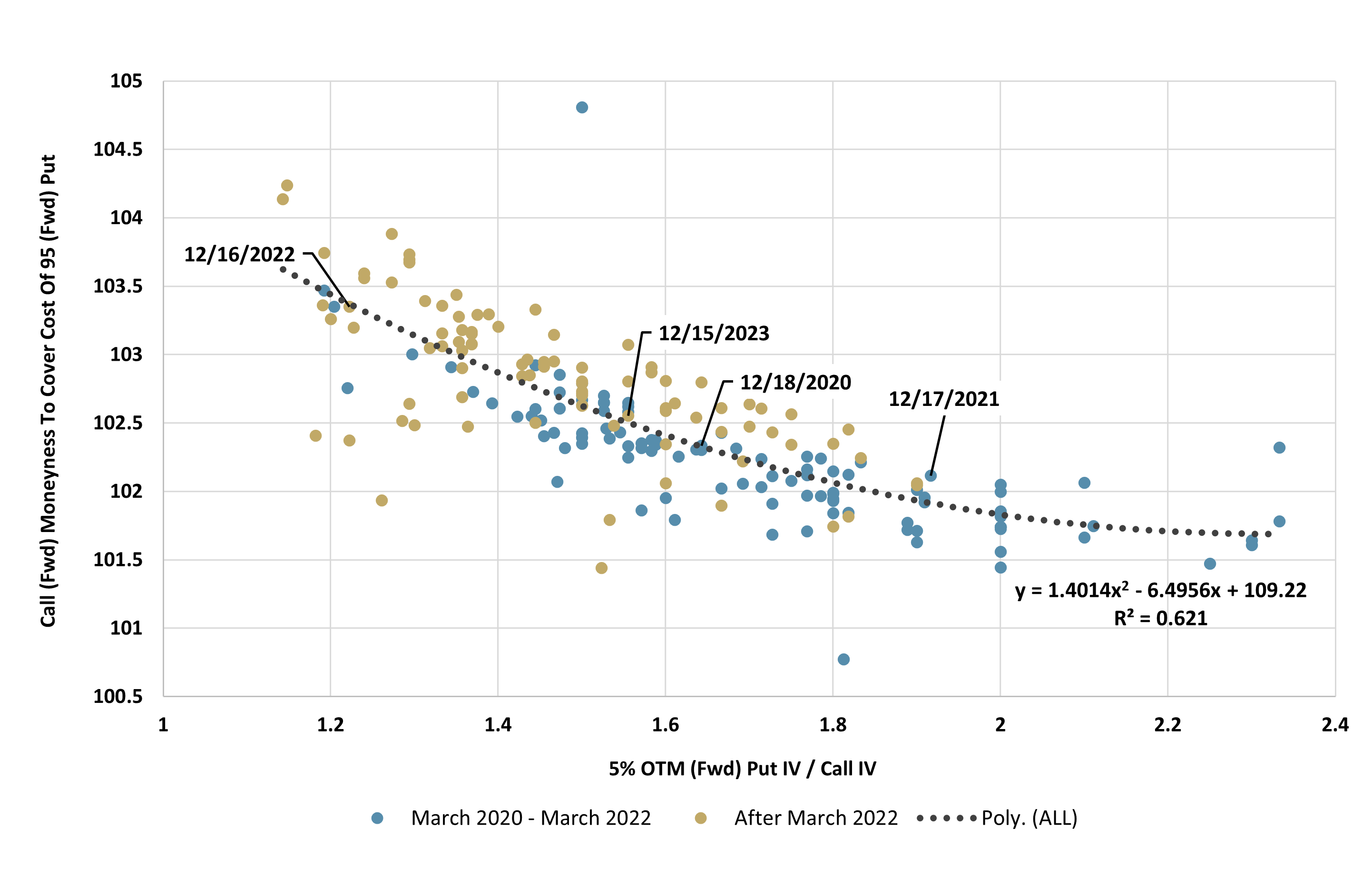

In Figure 4, we analyze the above idea within the context of the upside cap in “zero-cost” hedging, as well as bringing the impact of interest rates into the picture. We can clearly see the double impact of the volatility skew flattening and the interest rate hike when comparing the periods 2020/2021 and 2022/2023. When volatility skew flattens, the moneyness of the call option that could pay for a protective 95 moneyness put goes up, allowing for higher upside potential in the strategy. In the same fashion, while the relationship between these two variables remains the same, higher interest rates make calls synthetically more expensive, again pushing the required moneyness slightly further up, with the subsequent increase in upside potential, for similar levels of volatility skew.

Figure 4: Impact of Volatility Skew and Interest Rates

on Put-Call Relative Pricing

Moneyness: Describes the intrinsic value of an option's premium in the market. A contract is either “in the money”, “out of the money”, or “at the money”. A call option is said to be “in the money” when the future contract price is above the strike price. A call option is “out of the money” when the future contract price is below the strike price.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

0DTE Option: An options contract set to expire at the end of the current trading day.

Out of the Money: An option has no intrinsic value, only extrinsic or time value.

VIX Index: A real-time market index representing the market's expectations for volatility over the coming 30 days.