Volatility & Hedging Update

Equity Volatility & Hedging Update - November 2023

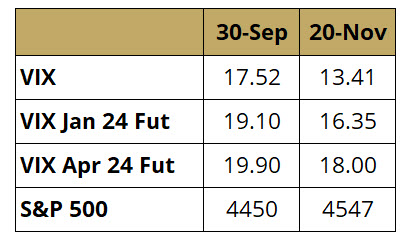

Table 1: Recent VIX History

VIX has declined this quarter alongside a very healthy 6% recovery in the equity market. As you can see in Table 1, short VIX strategies over this period (shown for two representative parts of the curve) gained handsomely, with the shorter end declining more.

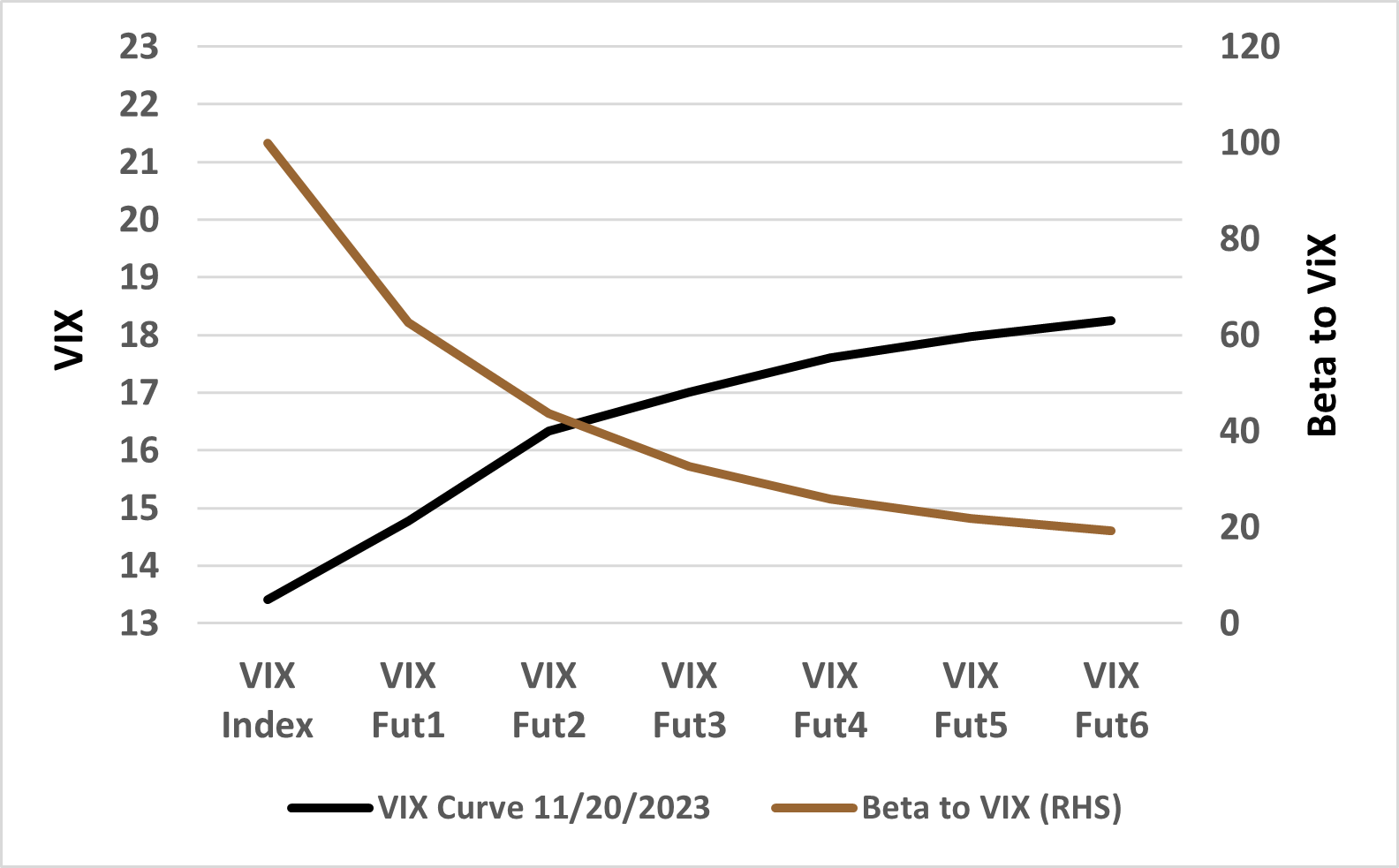

Low VIX is a result of not only improved risk sentiment, but also low levels of realized vol, which is potentially perpetrated by income strategies selling 0DTE options. Suppressed VIX has resulted in a steep VIX curve, with a healthy roll down across the curve, as illustrated in Figure 1. This chart also shows that long-dated VIX contracts have significantly lower beta to VIX. VIX is always vulnerable to a negative shock to risk sentiment, and more so when VIX is low, hence if one wants to short VIX in the current environment they should focus their efforts further out the curve to avoid excessive risk.

Figure 1: VIX Term Structure

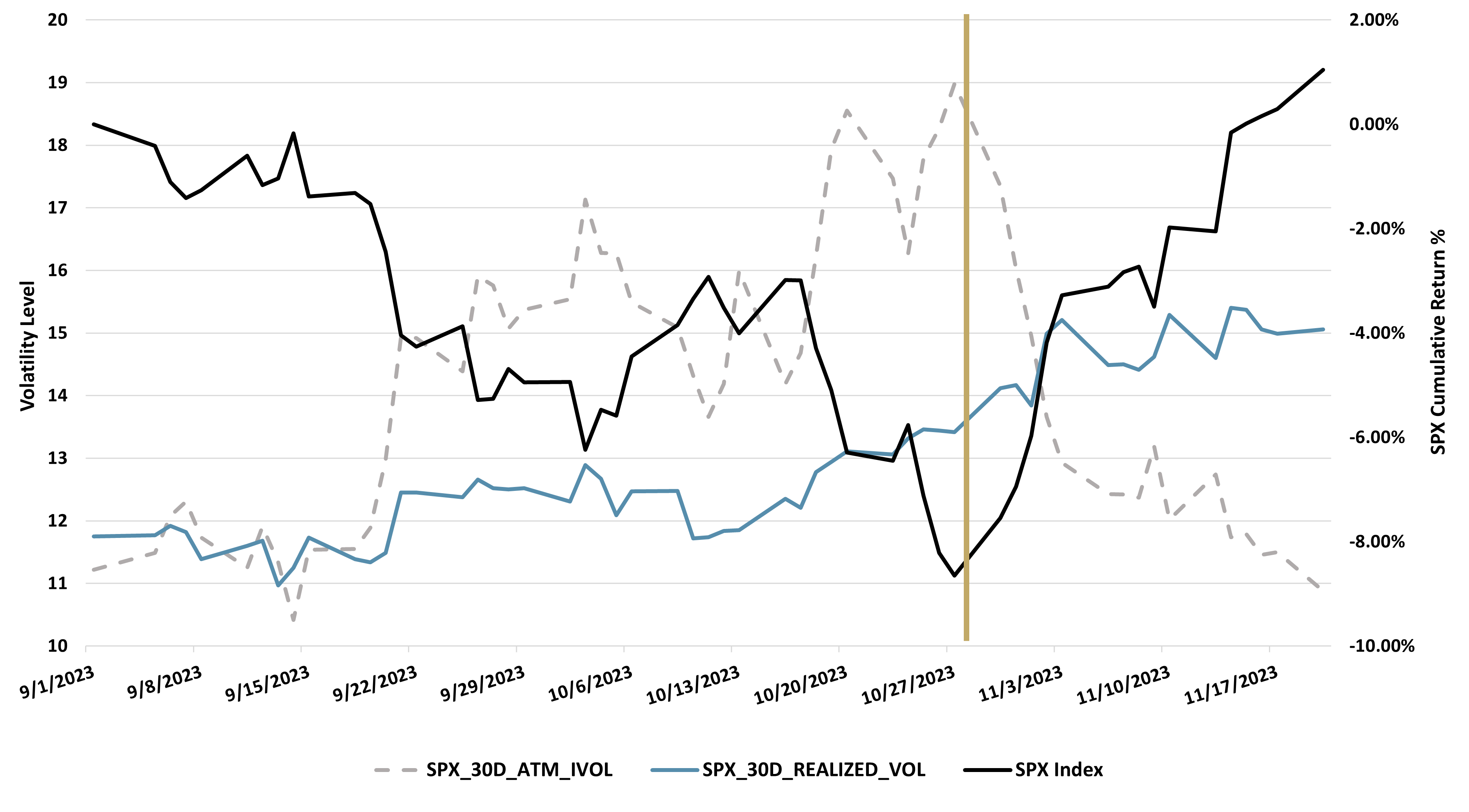

After the recent equity market down move during September and October, where VIX jumped above 20, the fast recovery during November has pushed implied volatilities (IV) well below realized vol (see Figure 2). The obvious reason for implied vols being based on forward volatility more than past volatility might be the fact that inflation keeps moving lower toward pre-COVID levels and therefore less intervention will be needed from the Fed.

Figure 2: SPX 1m ATM IV (LHS) vs. Realized Volatility (LHS) vs.

SPX Cumulative Return (RHS)

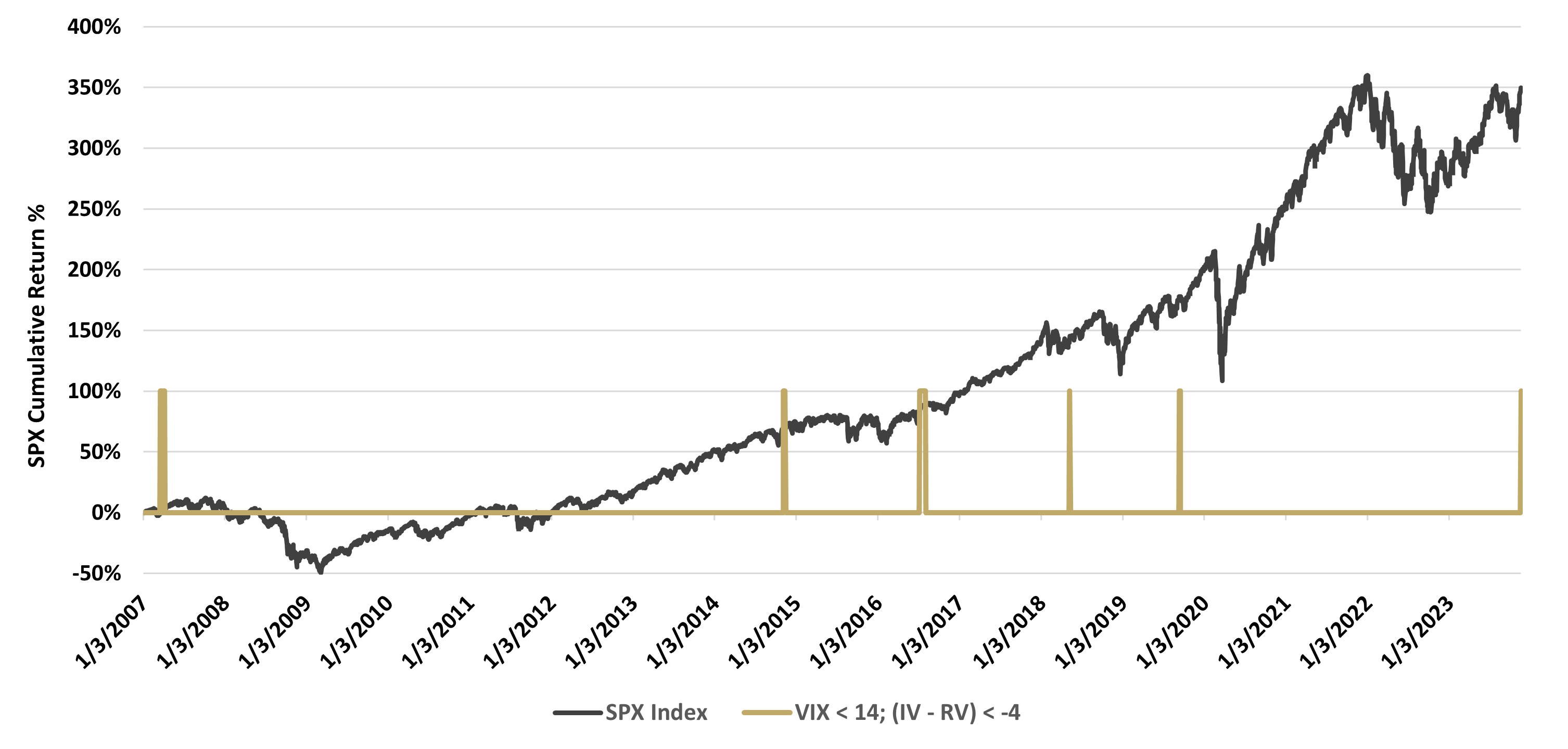

Current SPX 1m ATM IV is sitting more than 4 points below its 1m realized volatility, which has only happened 5 times before in the last 16 years when VIX is under 14 (see Figure 3).

Figure 3: Times Implied Volatility is 4 Points Lower

Than Realized Vol & VIX is Under 14

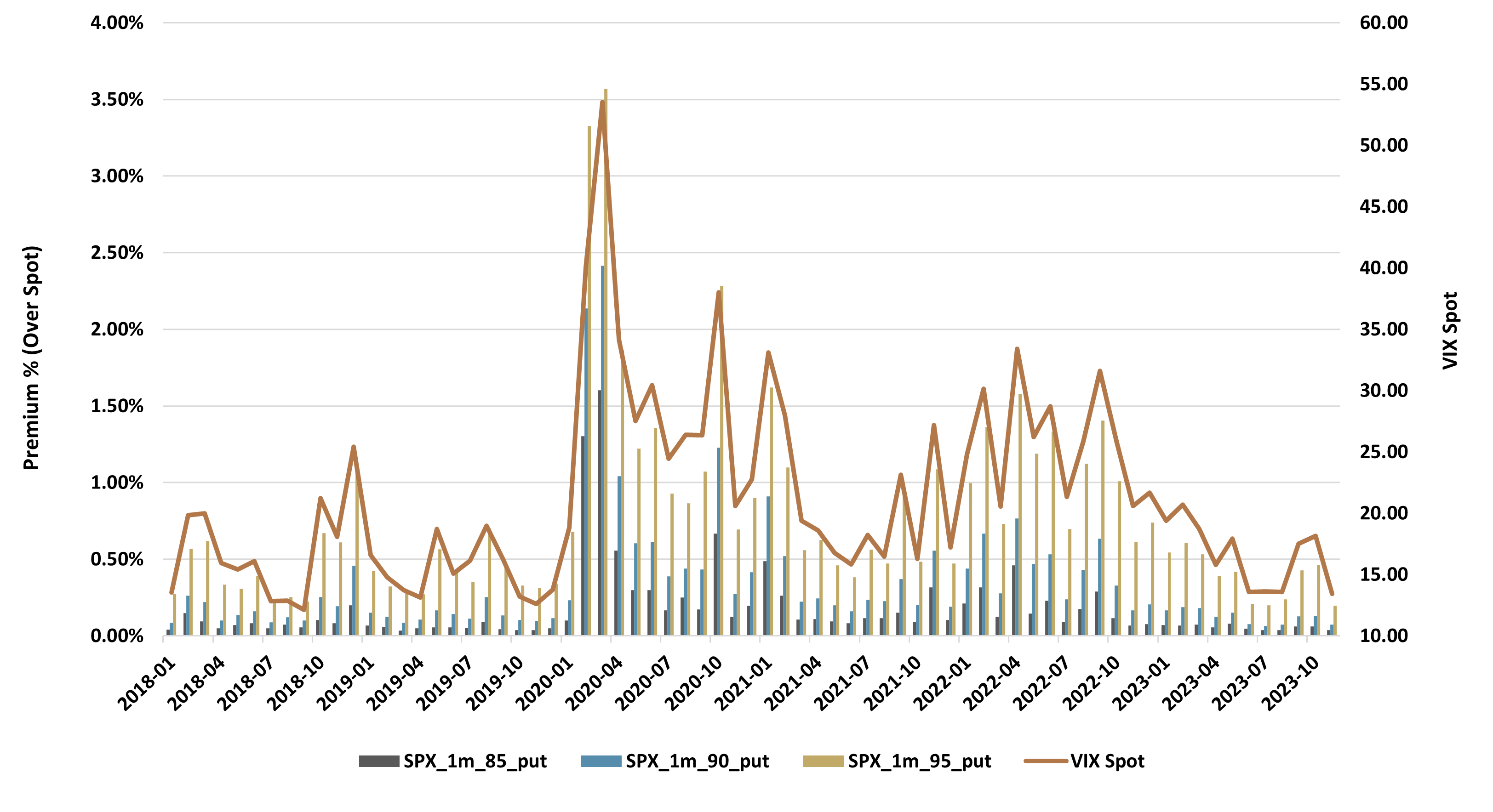

In this context, we are seeing the cheapest 1-month 95 moneyness put-based insurance costs since 2018, and close to the lowest levels of the last 15 years (see Figure 4).

Figure 4: Cost of 1-Month SPX Put Protection at 100% Notional (LHS)

vs. VIX (RHS)

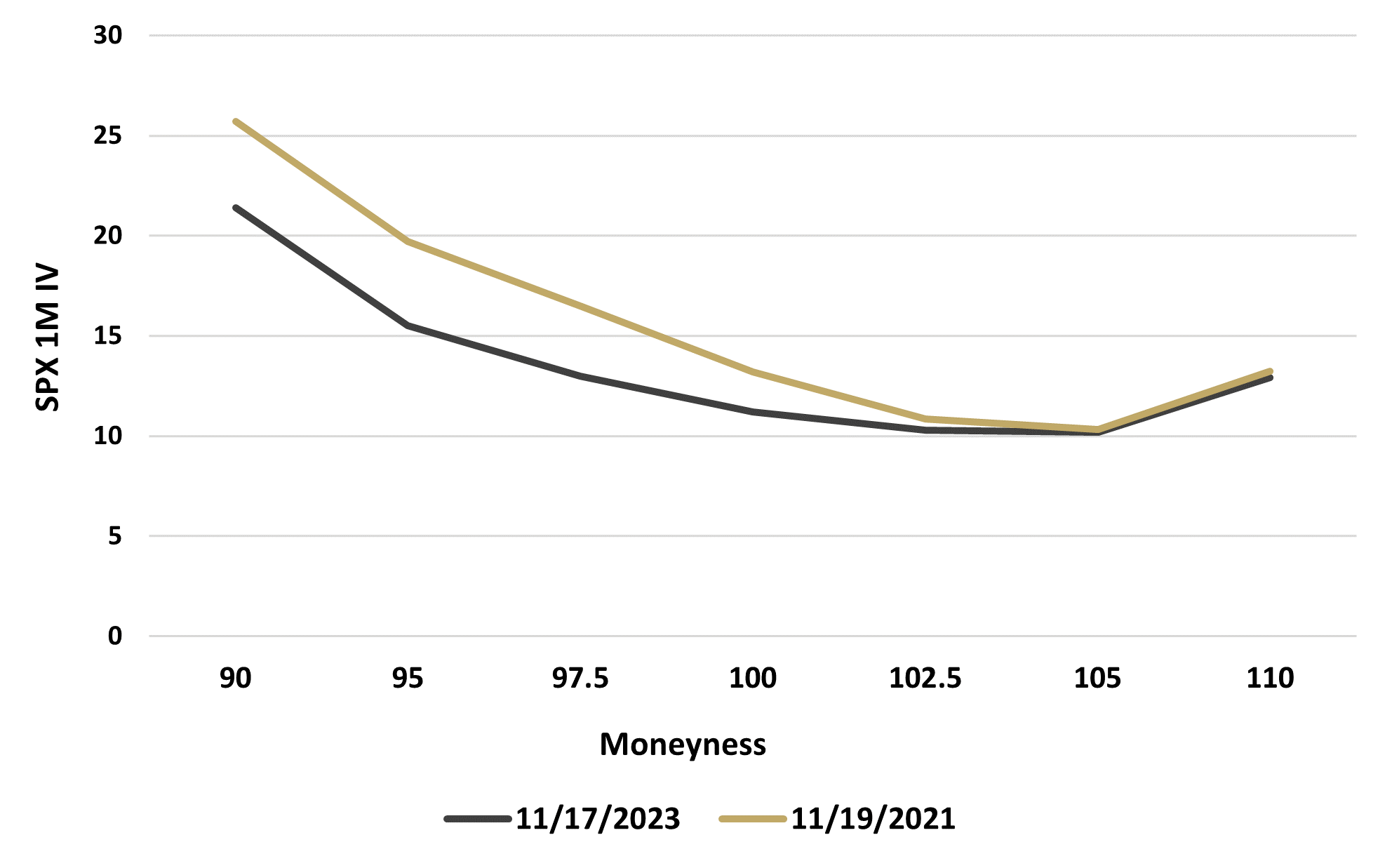

The improved overall equity market sentiment has also resulted in one of the flattest option volatility surfaces of the last five years. As we can see in Figure 5, the out of the money (OTM) put implied volatility has come down around 4 basis points compared to two years ago, with OTM call IV staying around the same levels.

Figure 5: SPX 1-Month Option Volatility Surface: Today vs. 2 Years Ago

GLOSSARY:

Basis Points (bps): A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Moneyness: Describes the intrinsic value of an option's premium in the market. A contract is either “in the money”, “out of the money”, or “at the money”. A call option is said to be “in the money” when the future contract price is above the strike price. A call option is “out of the money” when the future contract price is below the strike price.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

0DTE Option: An options contract set to expire at the end of the current trading day.

Out of the Money: An option has no intrinsic value, only extrinsic or time value.

VIX Index: A real-time market index representing the market's expectations for volatility over the coming 30 days.