Fixed Income Update

Rates & Mortgages Update – January 2024

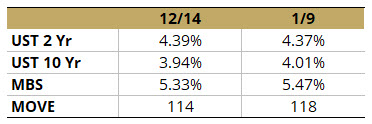

Table 1: Market Recap

We suppose it was worthwhile to come to work every day, except for the small detail that the UST 10-year rate closed 2022 at 3.87% and ended 2023 at 3.88%. There was the March panic that dropped rates by 75bps in short order, and then the summer 175bp rinse where that rate touched 5.00%, but never mind.

Despite an unchanged year, it was quite active, as noted by the MOVE Index which touched a near-record 180 in March and then spent the remainder of its time between 110 and 130, or an Implied Volatility of about 7.5bps per day. The big change on the year was the Yield Curve, which “steepened” (became less inverted) by 60bps to close out at negative 37bps.

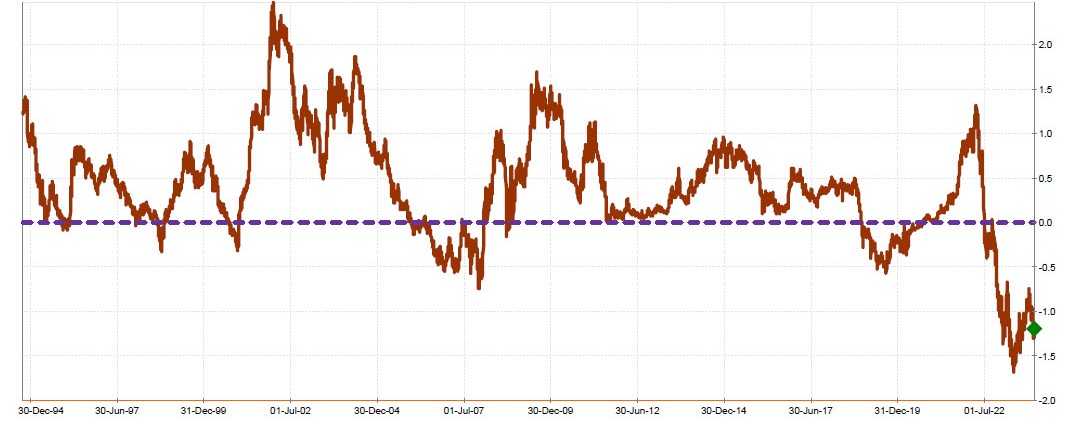

This leads to the big story for 2024 – When will the FED start cutting interest rates, and by how much? The FED has indicated three cuts of 25bps each, while the market is pricing in six cuts. The market’s aggressive pricing is best visualized by Figure 1 below, where the one-year forward one-year rate is 125bps lower than the current rate.

Our bet is the FED does not start cutting until July, and they only cut three times, but that and two bucks will buy you a coffee at the 86th Street bodega.

Figure 1: 1-Year Forward 1-Year Rate — Spot 1-Year Rate

Glossary:

Basis Points (bps): A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.