Introduction

Historically, investors have relied on traditional income sources such as dividend-paying stocks, bonds, real estate, and annuities to generate steady cash flow. However, these options have limited yields and can often fall short for investors in specific environments. That’s where derivative income strategies come in, offering a revolutionary approach to income generation using tools like options and futures. In this blog, we review four of Simplify’s equity income strategies and show how they can be used together to help investors meet their monthly income goals.

Simplify Equity Income Solutions

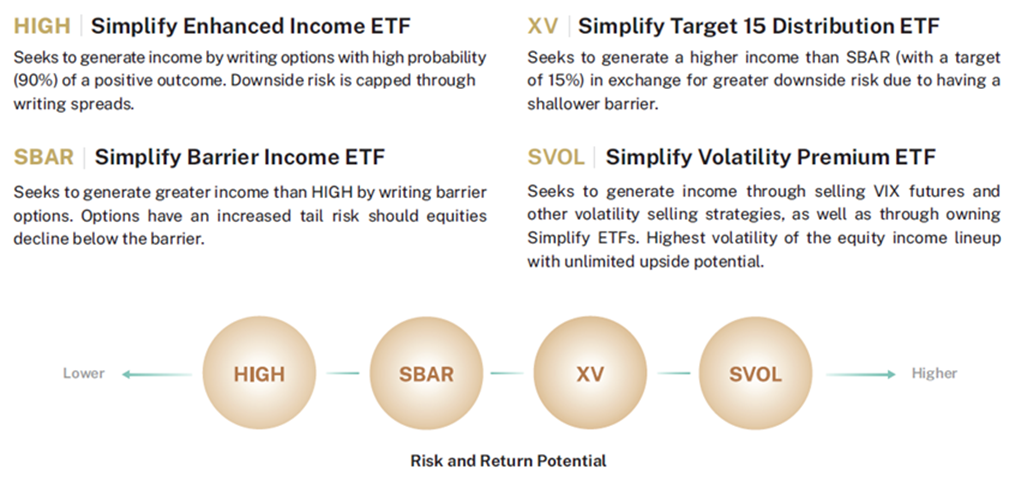

Simplify has developed four innovative ETF strategies tailored to help investors meet their income objectives. Each ETF employs a distinct income strategy—ranging from put spreads and VIX roll yields to barrier options—creating complementary exposures that can perform across varying market environments. These differentiated approaches are designed to perform across varying market conditions, helping investors manage risk while generating consistent monthly cash flow. Whether used individually or in combination, these ETFs provide flexible and complementary solutions to enhance income potential. Figure 1 provides a brief overview of each equity income ETF.

Figure 1: Simplify’s Equity Income ETFs

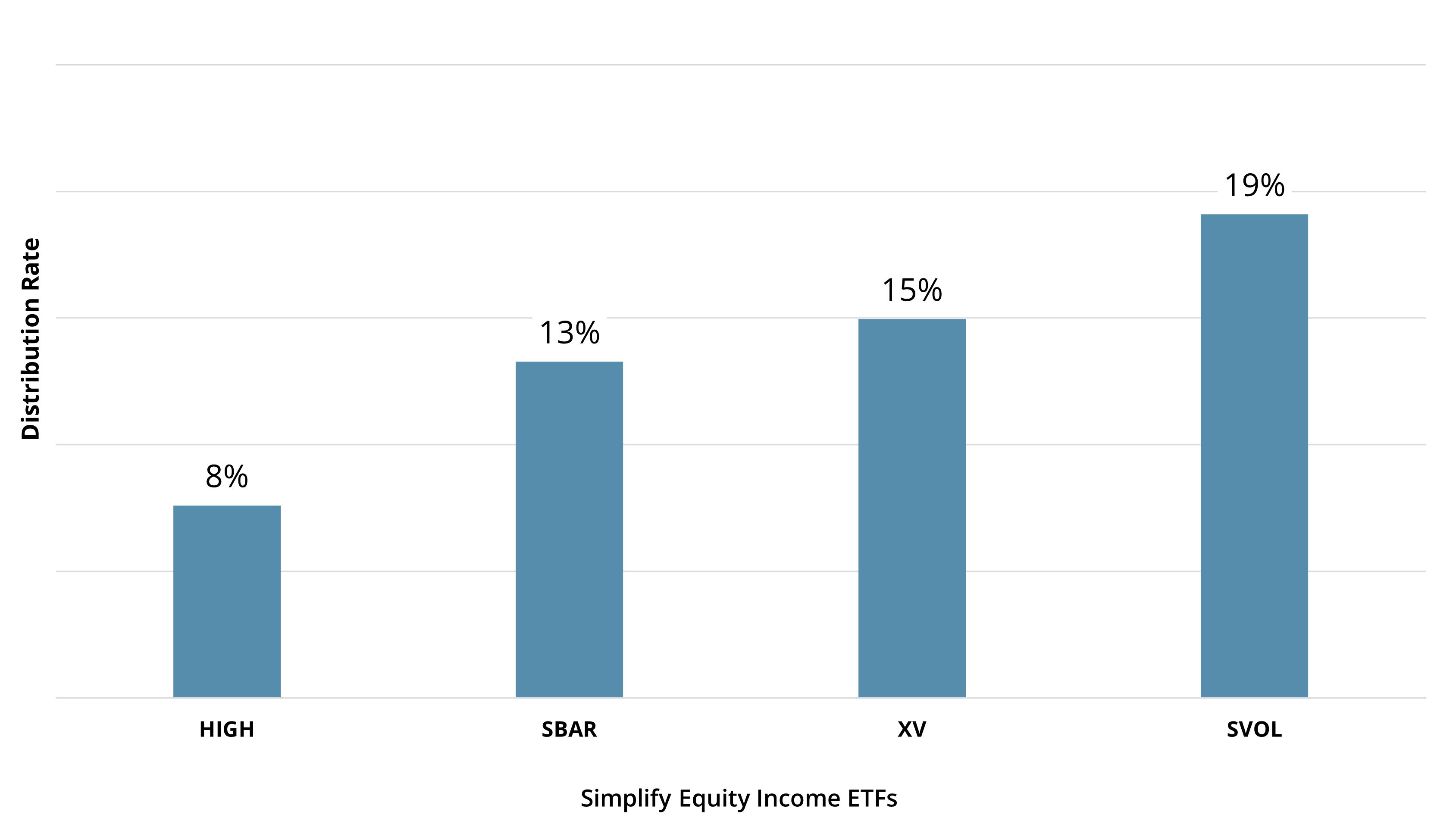

Simplify’s equity income ETFs are built to deliver consistent monthly distributions, offering investors reliable cash flow to support a variety of income needs. As shown in Figure 2, the annualized distribution yields as of May 2025 highlight the strength and potential of these strategies. Each ETF taps into a differentiated source of derivative-based income and is intentionally designed to align with a broad spectrum of risk tolerances, from conservative investors seeking stable income to those willing to accept higher risk in pursuit of elevated yields.

Figure 2: Simplify Equity Income ETFs - Distribution Rates

May 2025

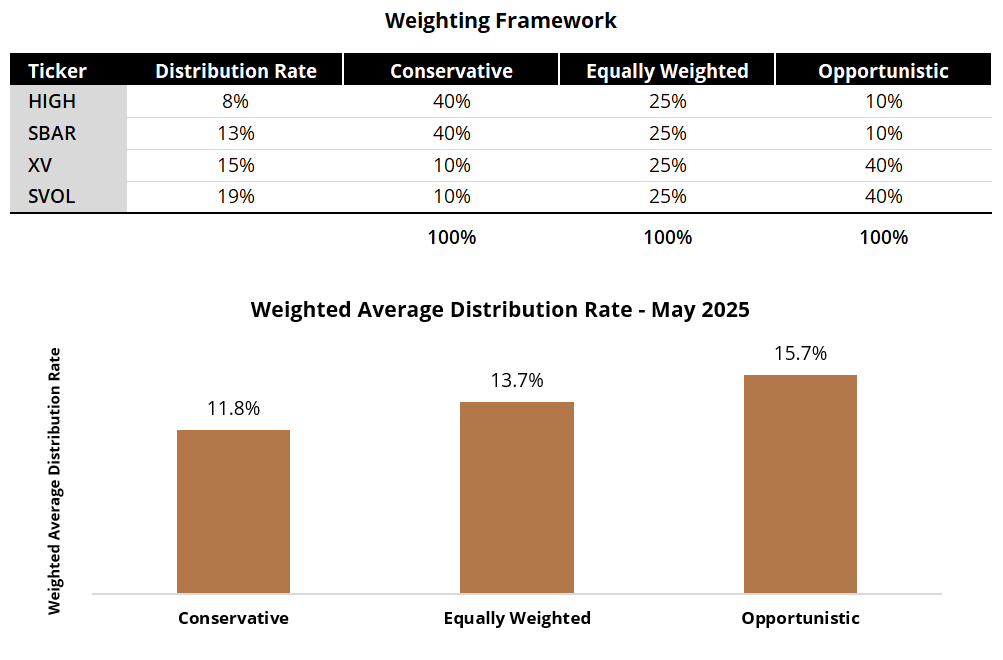

Combining Equity Income ETFs

Diversifying across Simplify’s derivative-based equity income ETFs offers a powerful way to mitigate strategy-specific risks while enhancing the consistency and resilience of income generation. Each ETF employs a distinct income strategy—ranging from put spreads and VIX roll yields to barrier options—creating complementary exposures that can perform across varying market environments. This multi-strategy approach not only smooths income delivery and reduces drawdown potential but also positions investors for stronger long-term, risk-adjusted returns. Figure 3 illustrates a thoughtfully constructed weighting framework and weighted average distribution rates, offering both conservative and opportunistic allocations to help investors tailor exposure based on their individual risk tolerance and income goals.

Figure 3: Weighting Framework and Weighted Average Distribution Rates

In Conclusion

For investors seeking dependable cash flow, our four differentiated equity income strategies offer powerful standalone benefits or can be combined into a comprehensive solution tailored to individual income goals. Each ETF taps into a unique source of derivative-driven yield—ranging from volatility harvesting to structured protection overlays—providing diversified income streams and dynamic risk control. These can then be combined to build diversified income solutions at very targeted yield levels.

GLOSSARY

Barrier Option: A type of customized over-the-counter option in which the underlying reference assets, tenor, and barrier level are negotiated with a counterparty. They set a threshold (“barrier”) below which the underlying notional value is fully exposed to the downside upon expiration.

Distribution Yield: The measurement of cash flow paid by an exchange-traded fund (ETF), real estate investment trust, or another type of income-paying vehicle. Rather than calculating the yield based on an aggregate of distributions, the most recent distribution is annualized and divided by the net asset value (NAV) of the security at the time of the payment.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price (“strike”) by a specific date (“expiry”). An “outright” is another name for a single option leg. A “spread” is when options are bought at one strike and an equal number of options are sold at a different strike, all at the same expiry.

Put Spread: Buying a put on a strike, and selling another put on a lower strike of the same expiry.

Risk-Adjusted Return: A calculation of the profit or potential profit from an investment that considers the degree of risk that must be accepted to achieve it. The risk is measured in comparison to that of a virtually risk-free investment, usually the U.S. Treasuries.

Volatility: A measure of how much and how quickly prices move over a given span of time.