Introduction

In 2022, investors faced a tumultuous year of market volatility, driven by inflation, rising rates, and geopolitical events. During such times, alternative diversification strategies such as hedged equity, managed futures, or rate-hedging strategies offered effective diversification benefits to the traditional 60/40 stock/bond portfolio. In this blog post, we review how a direct hedge via a hedged equity exposure to US equities provided a better return and drawdown profile than a proxy-hedged portfolio that uses bonds to hedge stocks.

When Correlations Flip

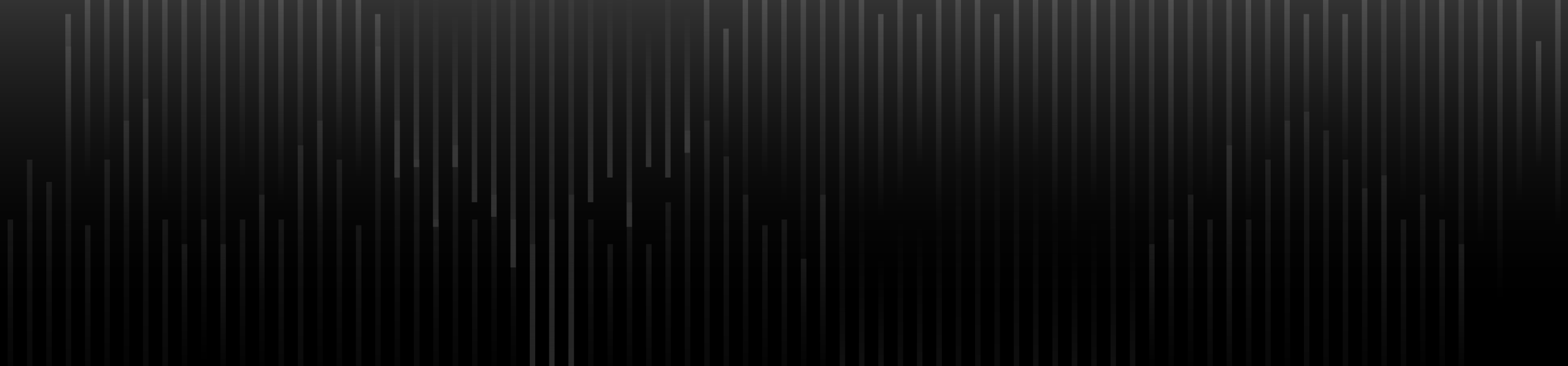

Last year was an extremely difficult environment for traditional asset allocation investors. In the decade prior, the assumption of balanced risk offered by negative correlations between stocks and bonds held true, as shown in Figure 1.

Figure 1: S&P 500 Index vs. Bloomberg Aggregate Bond Index

12/31/2011 – 12/31/2021

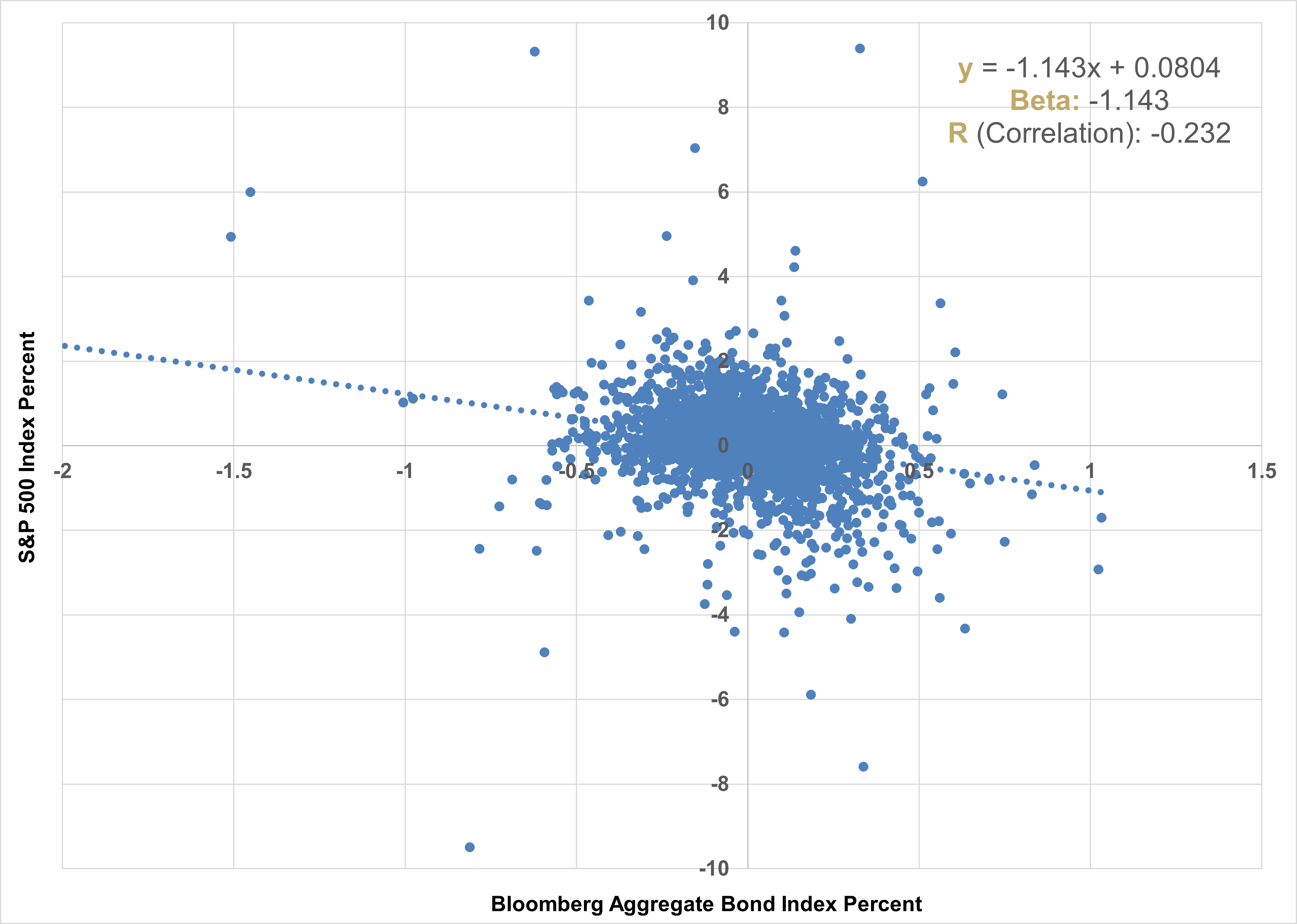

Figure 2: 2022 S&P 500 Index vs Bloomberg Aggregate Bond Index

12/31/2021 – 12/31/2022

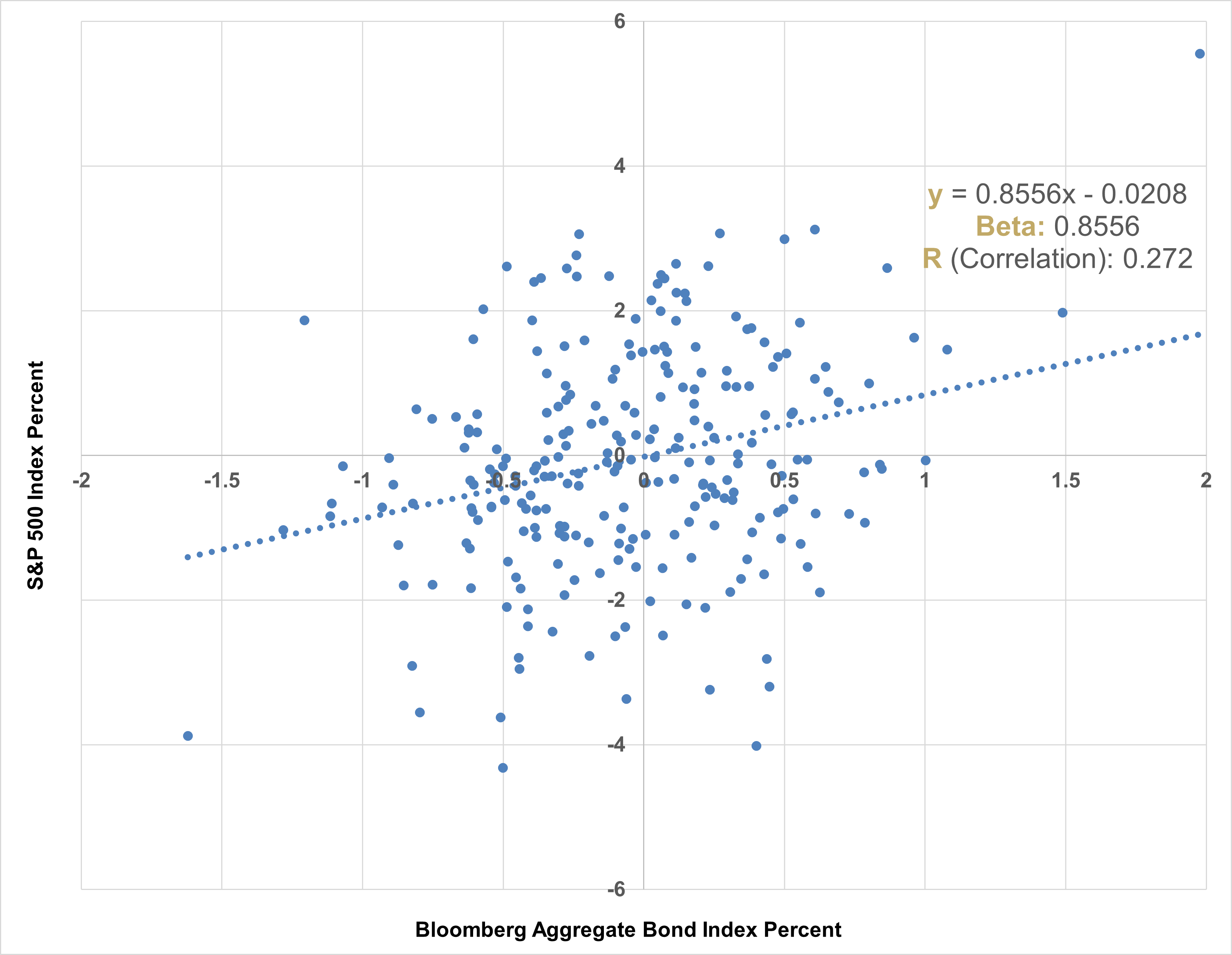

Figure 3: 60/40 Portfolio Max Drawdowns

12/31/96 – 12/31/22

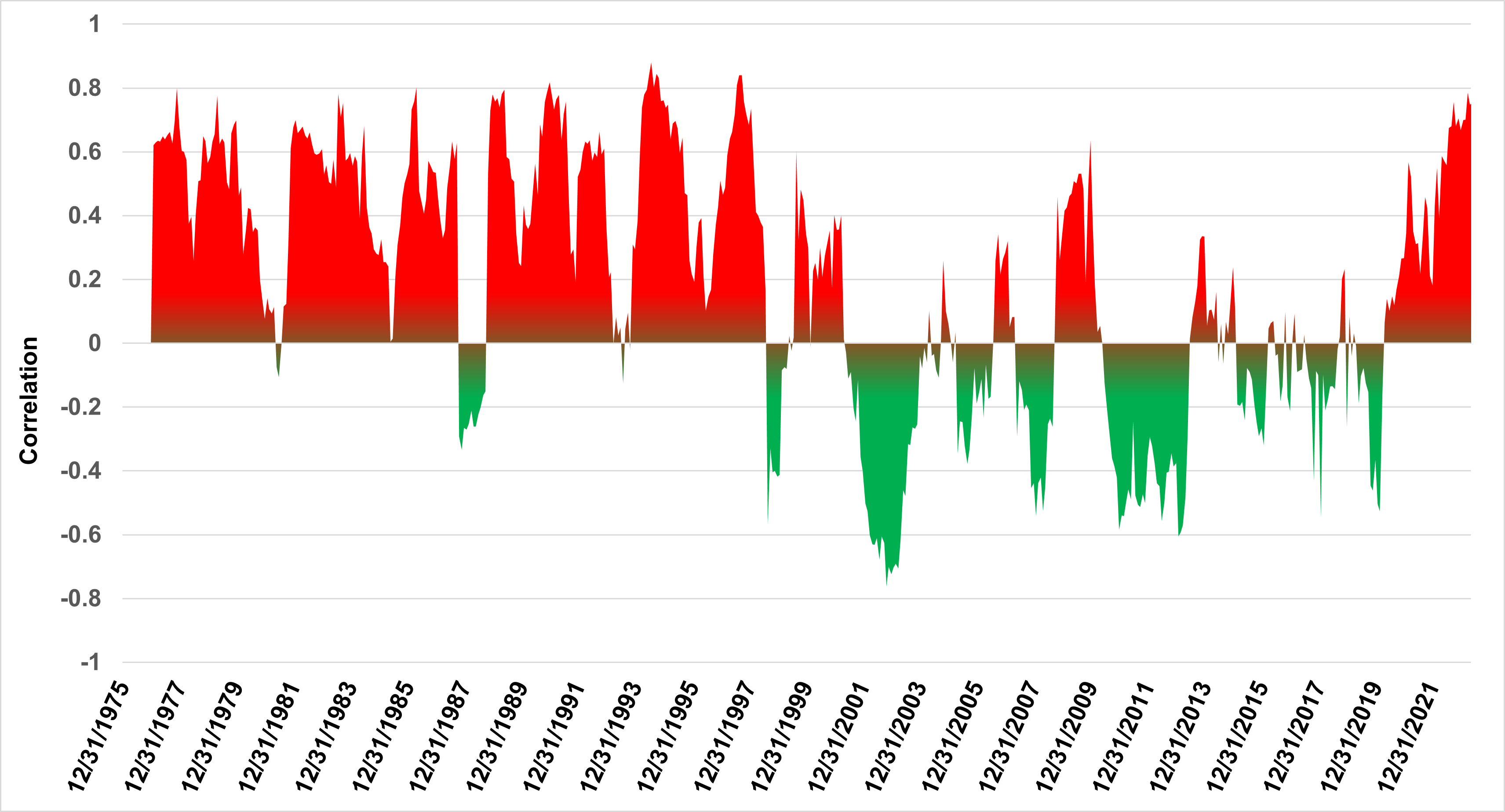

But was 2022 a one-off in an otherwise reliably balanced relationship? Not quite. Since the inception of the Bloomberg Aggregate Bond Index in 1973, stocks and bonds have been positively correlated most of the time. It wasn’t until the turn of the century that the 60/40 portfolio became a reliable portfolio construction in terms of offering diversification benefits. With the end of the bond bull market, are positive correlations here to stay, or simply a fleeting event? Figure 4 shows the historical relationship between the two asset classes.

Figure 4: S&P 500 Index vs Bloomberg Aggregate Bond Index, Correlation, Trailing 12 Mo.

12/31/75 – 12/31/22

An Alternative to 60/40

One alternative to hedging equity-focused portfolios with bonds is a hedged equity strategy. A hedged equity strategy is designed to provide downside risk mitigation while still participating in the market's upside by employing a combination of long and short options, most often in the form of a costless collar, with an underlying equity exposure to manage risk and volatility. This affords the strategy a direct, explicit hedge exposure using put options rather than the typical proxy hedge offered to stocks by bonds.

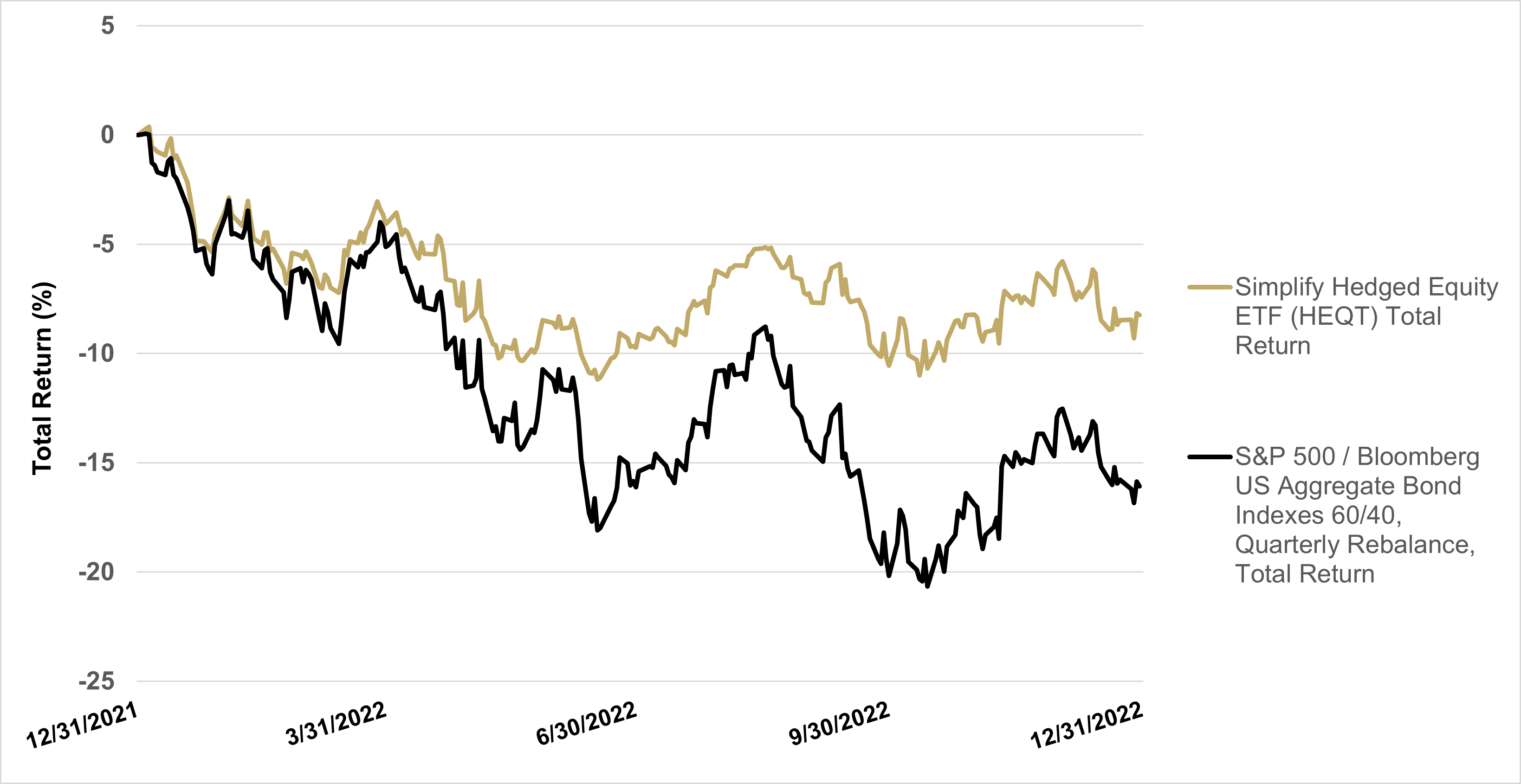

Simplify’s Hedged Equity ETF (HEQT), which holds a low-cost passive equity ETF and ladders monthly spread collars to cover the portfolio over the forward three months, experienced a lower max drawdown than a traditional 60/40 portfolio in 2022 while also delivering lower volatility and a superior calendar year total return. Figure 5 shows this single-year comparison.

Figure 5: HEQT vs. 60/40

12/31/21 – 12/31/22

The performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end please call (855) 772-8488 or go to https://www.simplify.us/etfs. The fund’s gross expense ratio is 0.53%. For the fund’s standardized performance, click here.

In Conclusion

Stock/bond correlations are not static, and investors should consider alternative ways to diversify equity-focused portfolios. A hedged equity strategy using laddered option strikes can provide an alternative to traditional stock/bond allocations and may deliver relative advantages during rising rate environments, among other potential scenarios. 2022 is a sobering reminder that there is no one-size fits all portfolio hedge and that proxy hedging equity exposures with bonds can be complemented by other diversification methods.

View HEQT Fund Insights Video Recap

GLOSSARY:

Beta: Slope coefficient of a linear regression between the S&P 500 Index and the underlying asset.

Bloomberg Aggregate Bond Index: A broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

Spread Collar: A strategy that involves buying a downside put and selling an upside call that is implemented to protect against large losses, but that also limits large upside gains.

S&P 500 Index: The index includes 500 leading US large cap companies and captures approximately 80% coverage of the available market.