Introduction

The Simplify Currency Strategy ETF (FOXY) launched on February 3, 2025, delivering a first-year NAV total return of over 20% (from 02/03/25 through 02/03/26). In addition, we believe its pattern of returns has provided valuable diversification to the traditional 60/40 portfolio. Despite those strong results, there may be an adoption hurdle for investors who are unfamiliar with currency investing. In this write-up, we review the basics of currency investing and show how FOXY has produced its diversifying returns.

Currency Investing 101

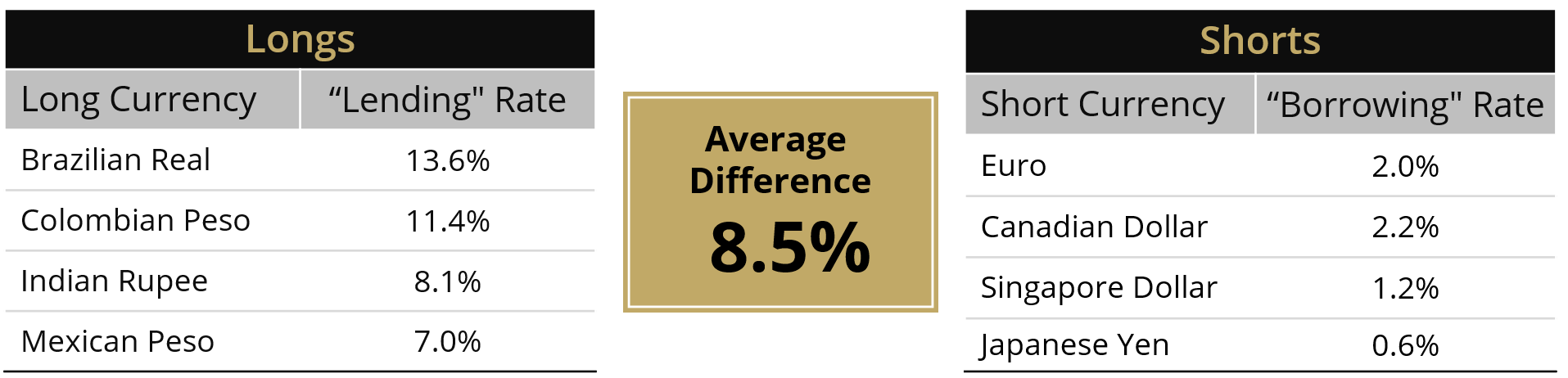

When one goes to the American Express counter at the airport and exchanges U.S. dollars for, say Mexican pesos and then puts them in a wallet, the peso cash does not earn any interest. But in institutional foreign exchange (FOREX) investing, buying (going long) a currency potentially results in an investor earning a yield in that currency, whether by holding foreign currency bills, bonds, or via an FX forward contract. Conversely, selling (going short) a currency can be equivalent to borrowing at an interest rate specific to the sold currency. For example, a pairing of short euro yielding 2% and long Brazilian real yielding 13.6% may earn the difference of 11.6%.

FOXY expands on this construct, building a portfolio of long high-interest rate currency/short low-interest rate currency positions with its return owing primarily to the rate differentials between them. The portfolio historically has held about 14 different exchange rate positions in an effort to ensure appropriate diversification. Figure 1 shows an illustrated example portfolio.

Figure 1: Illustrated Example Portfolio

The example above highlights another important point: FOXY avoids expressing a view on the U.S. dollar. The long and short positions in foreign currencies are roughly matched to avoid reliance on the appreciation or depreciation of the U.S. dollar to help generate returns.

Currency Investing 201

Some clients have inquired as to whether this type of investing is the oft-mentioned “carry trade,” which can unwind (sometimes violently), as happened in August of 2024 when the Japanese yen was the go-to funding currency. In fact, it is. So, in addition to diversifying over many currency positions as mentioned above—both long and short—FOXY’s process incorporates two additional considerations to guard against the impactful drawdowns that static long high-rate/short low-rate strategies are subject to.

First, FOXY aims to isolate what individual currencies offer from a portfolio construction point-of-view. For example, Emerging Market currencies tend to generate higher yields and exhibit more trend-like behavior, while G10 currencies can provide a valuable cushion amid volatility. Secondarily, FOXY uses volatility to size individual currency positions, the balance between EM and G10 currencies, and the overall level of longs and shorts in the portfolio. This further enhances diversification and helps to calibrate the expected return and volatility profiles of the fund.

Currency Investing 301

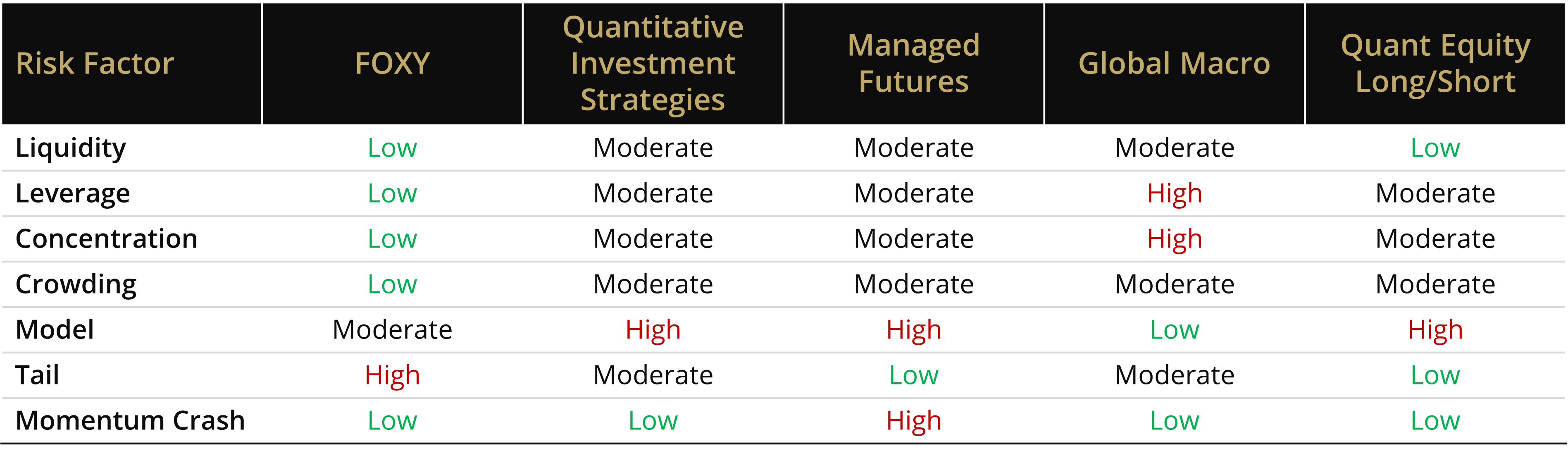

It is critical for an investor in any alternative strategy to understand the risks they are taking. Figure 2 shows a table of selected risks that alternative investments typically expose an investor to beyond the traditional equity, credit, and duration risk. For a full review of these risks, please see our prior discussion defining them.

We believe FOXY's highest risk factor sensitivity is to Tail Risk, as macro-related market shocks are likely to weigh on specific currency returns until markets stabilize. FOXY is also moderately sensitive to Model Risk: as a systematic strategy, it does rely on historical relationships, which can weaken over time.

Figure 2: Risk Factors Associated with Common Liquid Alternative Strategies*

Conclusion

FOXY aims to provide attractive returns with limited correlation to stocks and bonds. Thus far, it has delivered on that mandate with a 20.7% NAV return (from 02/03/25 through 02/03/26) and a distribution rate in the 8 to 10% range. We believe it can play a valuable role as part of an alternatives allocation for investors who understand how the strategy works and are comfortable with the risks FOXY underwrites.

GLOSSARY

Carry: The return obtained from holding an asset, assuming the underlying price of the asset remains stable.

Duration: A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Volatility: A measure of how much and how quickly prices move over a given span of time.