Introduction

In an evolving investment landscape, the allure of health care as a strategic component of a well-rounded portfolio has never been more compelling. This sector, known for its combination of resilience and innovation, offers a unique proposition to investors seeking to diversify and strengthen their traditional 60/40 investment portfolios. In this Fund Insights post, we will make the case for integrating health care, particularly through actively managed funds like the Simplify Health Care ETF (PINK), by exploring the intrinsic growth potential and other broader macroeconomic factors.

Strategic Rationale for Health Care Investment

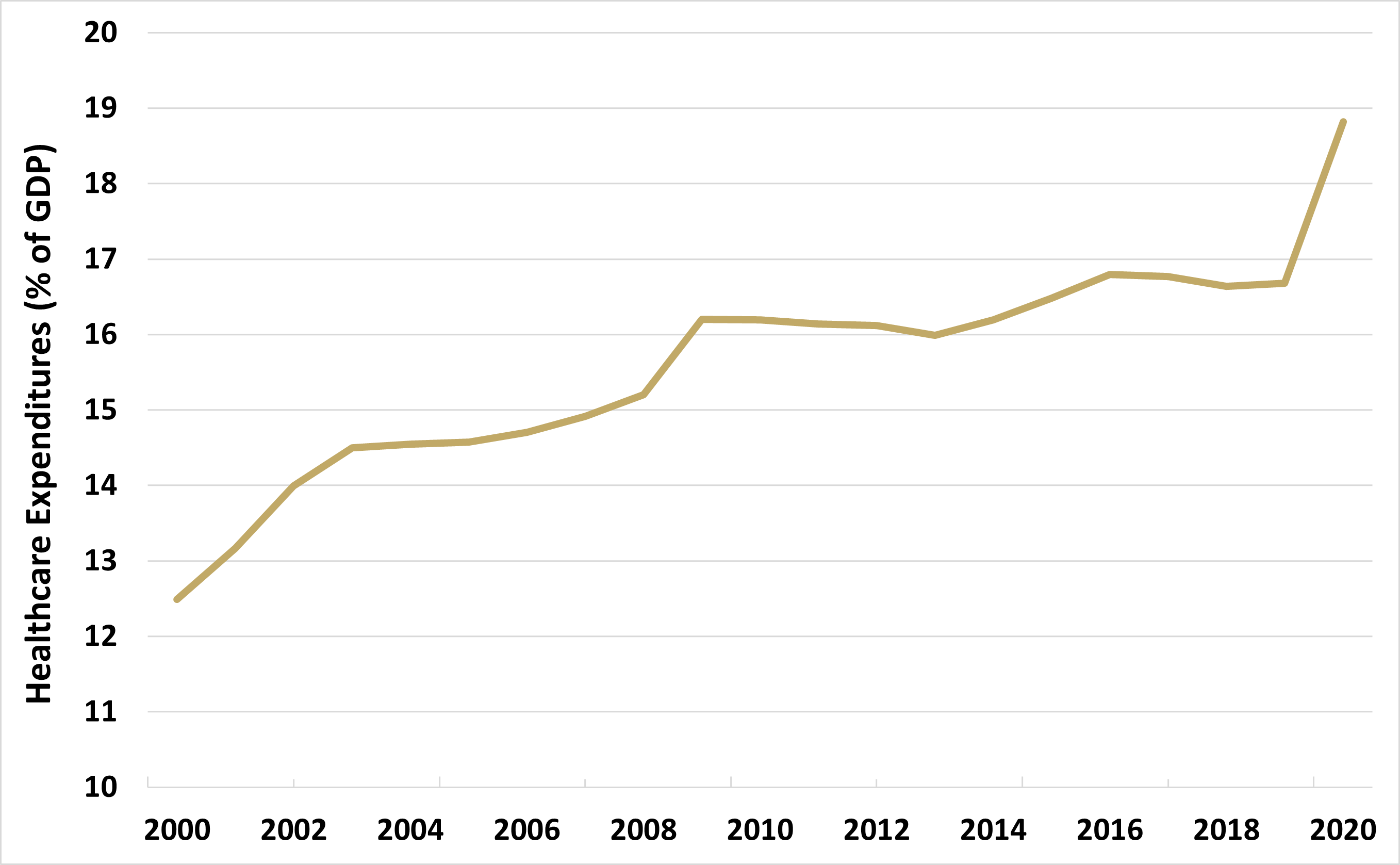

Health care has consistently demonstrated its capacity to outperform many other sectors during various market phases, especially in times of economic uncertainty or inflationary pressures, as its essential nature makes it less cyclical and more defensive. Additionally, the healthcare industry, which, as shown in Figure 1, is nearing 20% of US GDP, is expected to outpace the growth of the broader economy over the next decade. According to the The World Bank, the industry is projected to see a 5.4% annual average growth between now and 2031. This growth is driven by an aging population, innovations in medical technology and chronic disease treatment, and investment in health care infrastructure.

Figure 1: Health Care Expenditure as % of US GDP

2000-2020

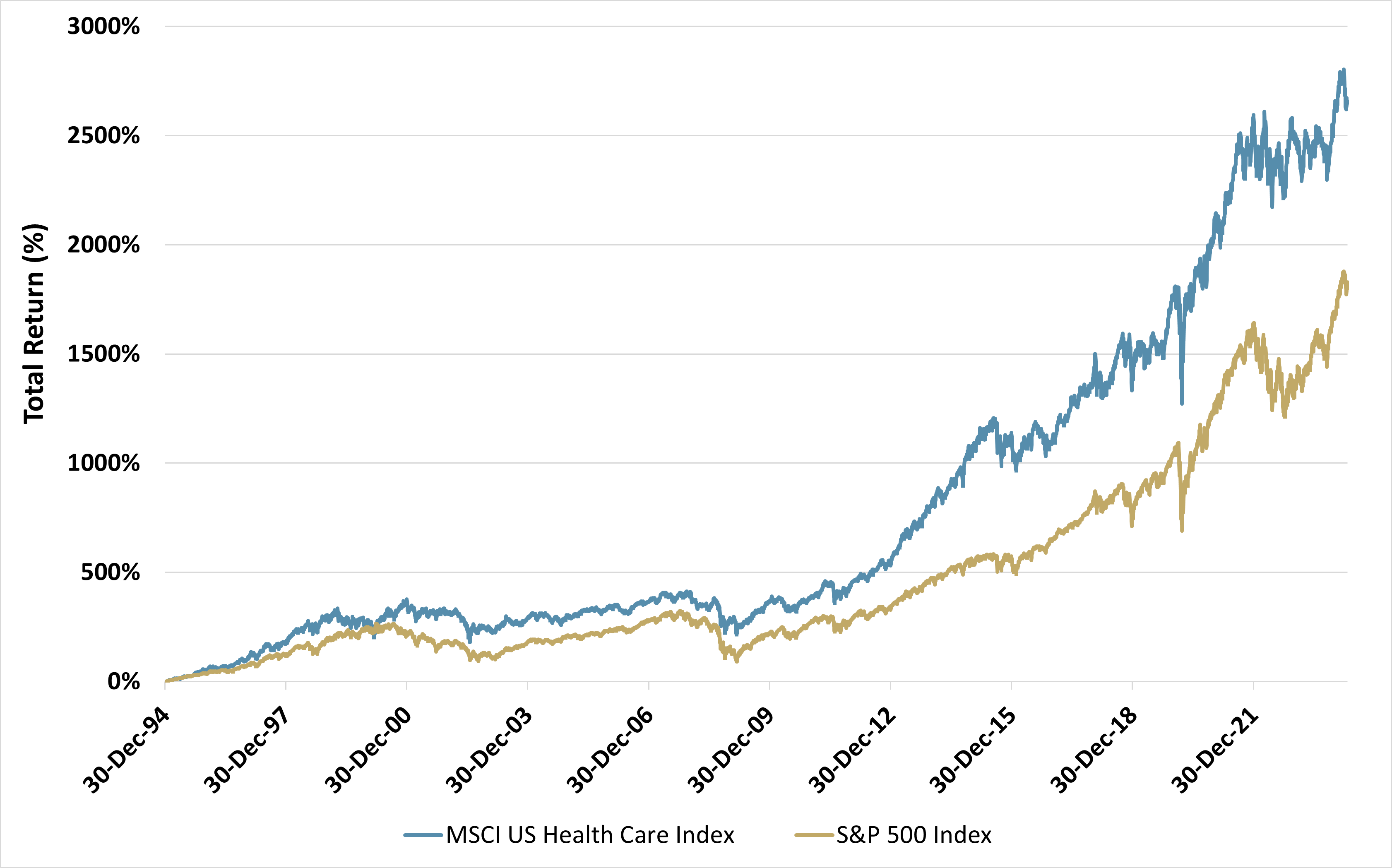

The strong upward trend in industry growth can be seen in the relative strength of health care stocks, as represented by the MSCI USA Health Care Index, versus the S&P 500 Index (SPX). Figure 2 shows this performance differential since the Index’s inception in 1995.

Figure 2: Health Care Stocks vs SPX, Total Return

1/2/1995 - 4/30/2024

Past performance is no guarantee of future results.

It is not possible to invest directly in an index.

Enhancing the 60/40 Portfolio with Health Care Stocks

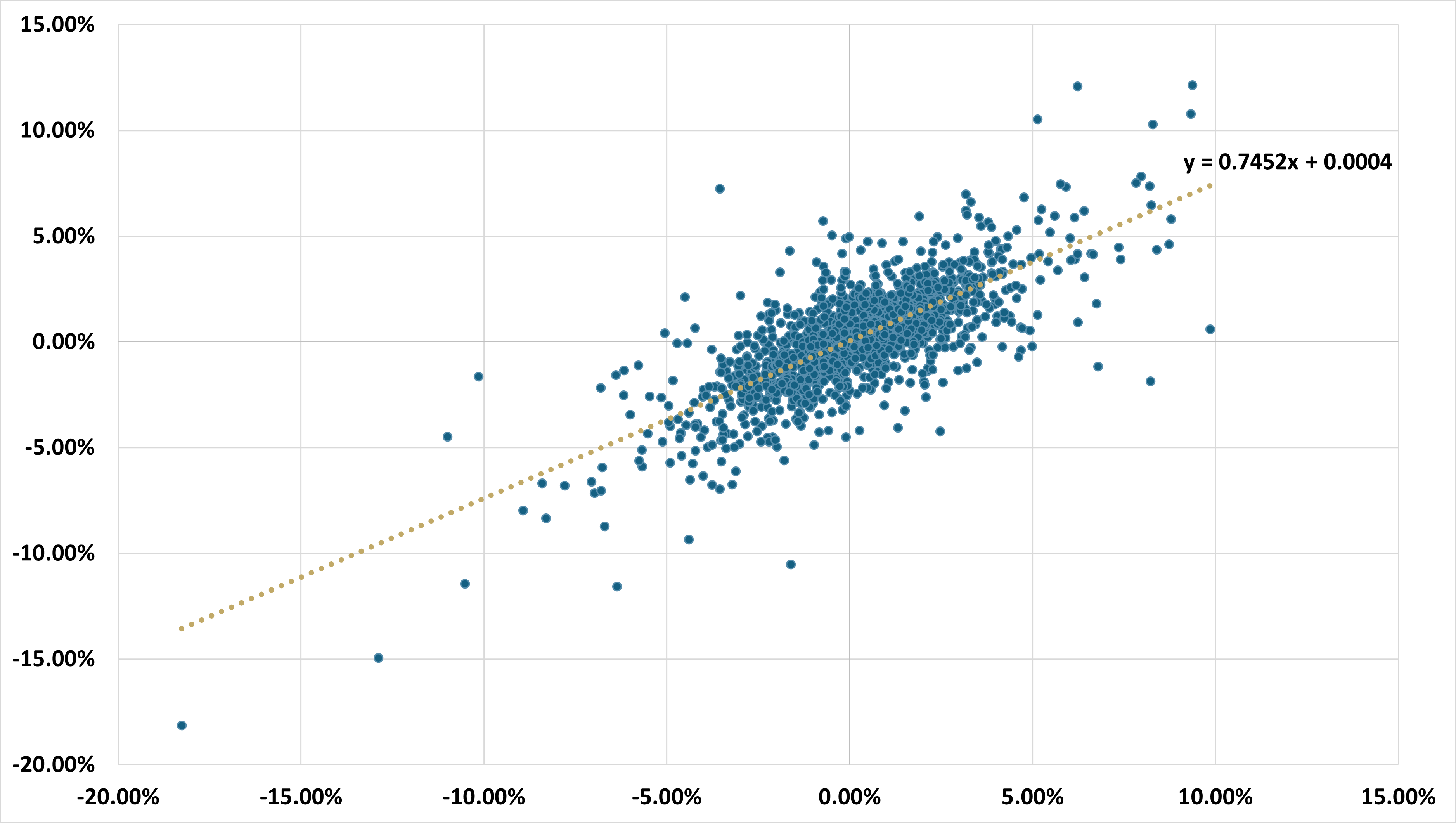

Traditionally, the 60/40 portfolio aims to balance the growth potential of equities with the stability of bonds. However, with the potential for an economic slowdown and pullback from all-time highs for large-cap equity indices, adding health care equities offers a strategic method to enhance portfolio diversification. Health care stocks tend to be less sensitive to economic cycles, providing stability and potential growth, even when other sectors falter. And as we showed in Figure 2, this has resulted in a strong outperformance for the broader sector. Since its 1995 inception (until April 30th, 2024), the MSCI USA Health Care Index has displayed a reduced beta of 0.75 to the S&P 500 Index (SPX) (see Figure 3).

Figure 3: Health Care Stocks vs. SPX

Regression of Weekly Total Returns

1/2/1995 - 4/30/2024

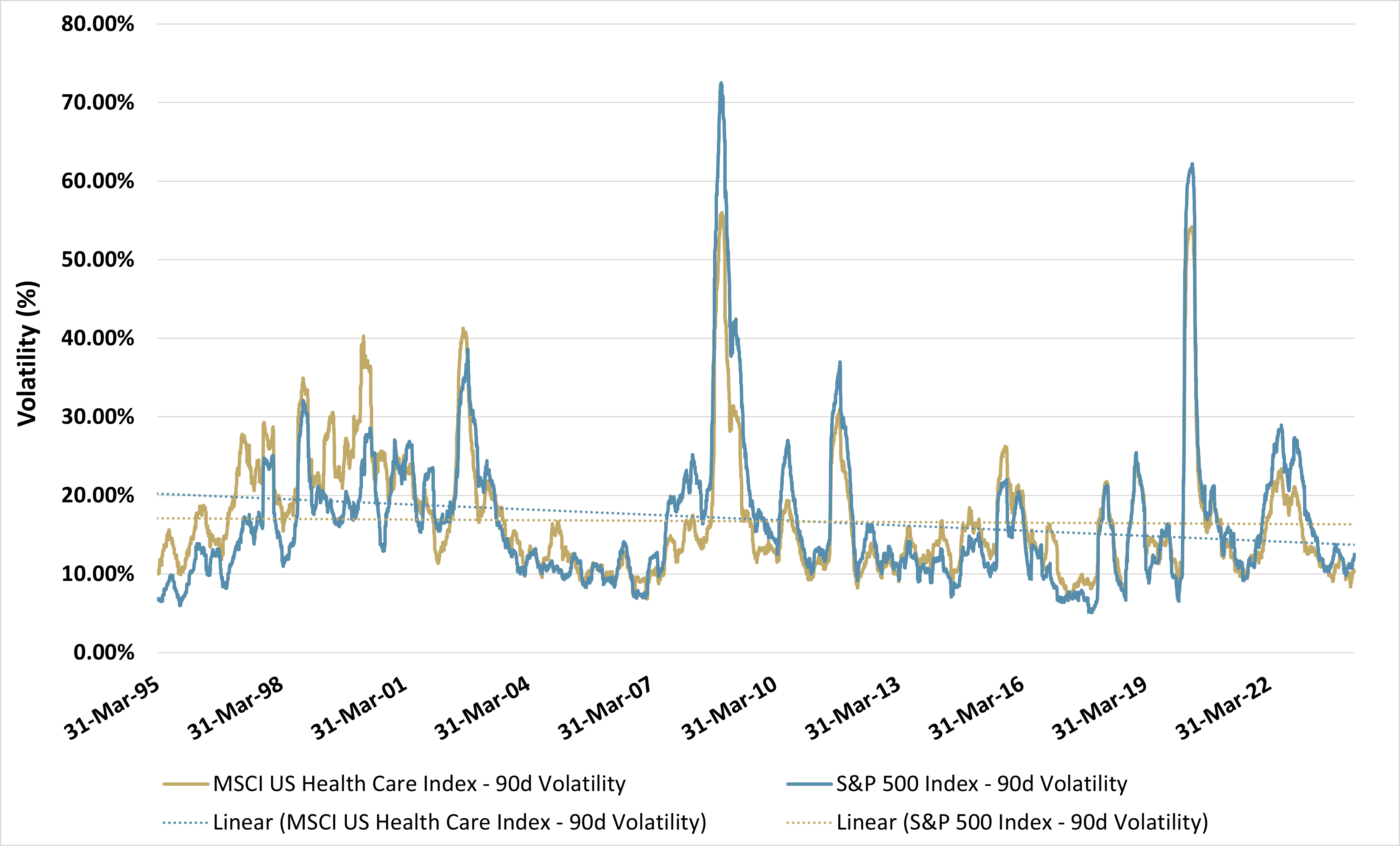

Further, health care stocks have displayed volatility profiles similar to the broad market index while benefiting from trending lower in recent years, as shown in Figure 4 below. Health care stocks also had lower maximum average drawdowns during the full assessment period - averaging ~9.6% max drawdowns when compared to SPX’s -11.44%. These characteristics make health care equities a prudent choice for investors aiming to mitigate cyclical equity risk and enhance risk-adjusted returns within the classic portfolio of stocks and bonds.

Figure 4: Health Care Stocks vs SPX, 90-Day Trailing Volatility

1/2/1995 - 4/30/2024

The Case for Active Management in Health Care Investing

The healthcare sector's complexity and rapid evolution require nuanced understanding and agility that active management can provide. Active managers can navigate the intricacies of regulatory changes, patent cliffs, and rapid technological advancements, areas where passive funds might lag. By actively selecting companies at the forefront of innovation—such as biotechnology pioneers or telemedicine leaders—the Simplify Health Care ETF, PINK, led by industry-veteran portfolio manager Mike Taylor, can seek to capitalize on growth opportunities quickly and adjust portfolios in response to emerging risks.

It's also important to note that within the MSCI USA Health Care Index, 890 names have been included in the index in the last 10 years (4/30/2014 - 4/30/2024). During that time, 10 names accounted for 56% of the index’s total return. Another 498, or well over half, of the included companies negatively contributed to the overall index during their time as member constituents.

When assessing the same index from 10/7/2021, PINK’s inception date, the results are even more jarring. 619 individual companies were included in the index during this time and 435 of said companies negatively contributed to the index’s total return with only a handful of names having a meaningful positive impact on the aggregate total return.

With very few significant winners and very many potential losers, the opportunity for active management is high in the health care sector.

Why Consider the PINK ETF?

The PINK ETF exemplifies an active approach by concentrating on high-potential sub-sectors within health care, such as biotechnology and pharmaceuticals, which are likely to benefit from demographic trends, such as aging populations and increasing health consciousness. Moreover, the ETF structure allows for tactical adjustments that are crucial in a sector where the regulatory landscape and competitive dynamics are constantly evolving. And while selecting the right companies is important, equally important is the omission or avoidance of firms that may be facing business risks such as regulatory scrutiny, trial failure, or patent expiration.

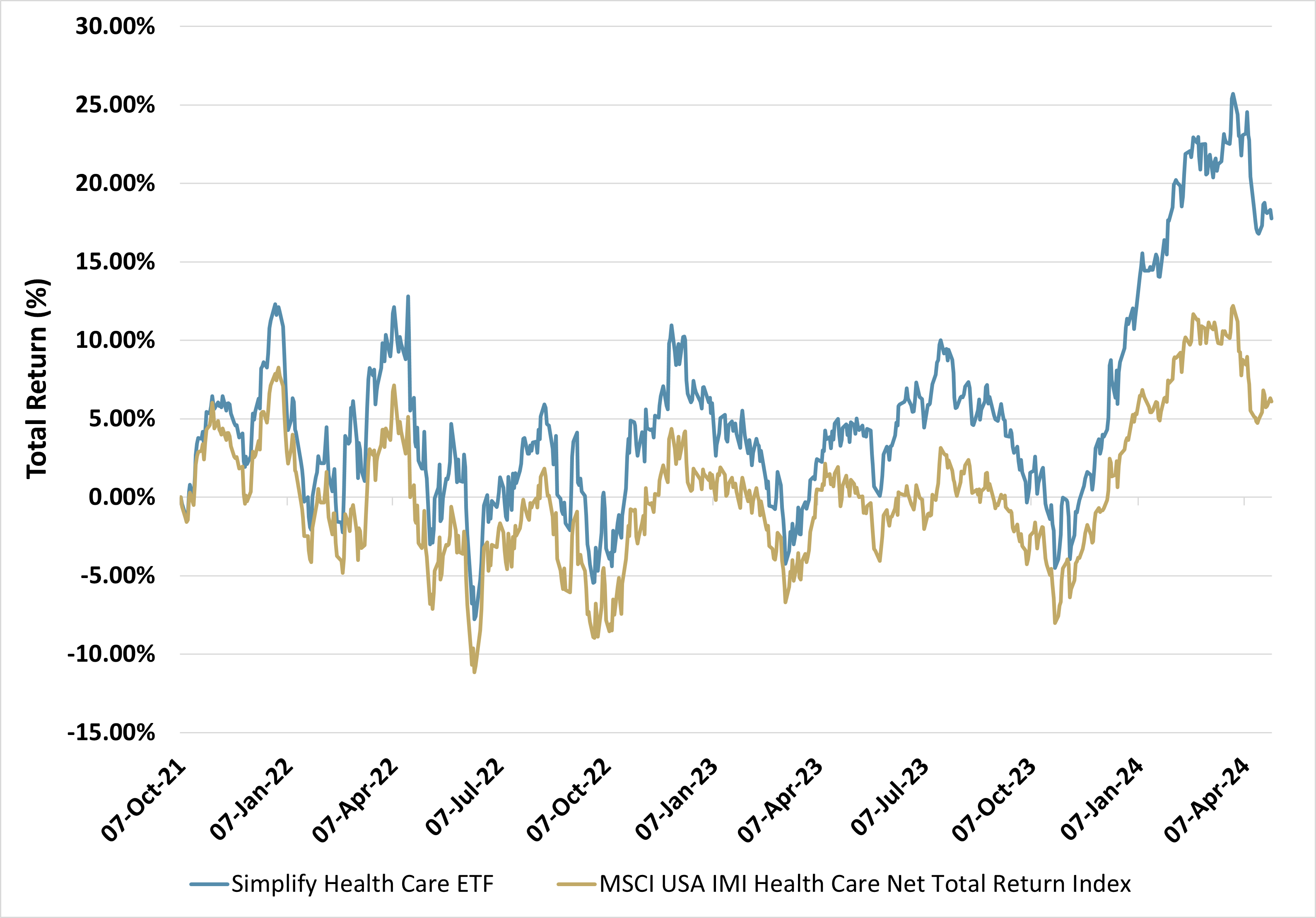

Since launching in October of 2021, PINK has outperformed its benchmark of the MSCI USA Health Care Index by over 11%, as displayed below in Figure 5.

Figure 5: PINK vs MSCI USA Health Care Index, TR

10/7/2021 - 4/30/2024

The performance data quoted represents past performance and is no guarantee of future results. For the current standardized performance and the most recent month-end performance, please call (855) 772-8488 or visit the Fund's website at simplify.us/etfs/pink-simplify-health-care-etf.

In Conclusion

Incorporating an overweight position to health care in a traditional 60/40 portfolio not only diversifies risks but also introduces an element of growth potential that is hard to replicate in other sectors. The strategic use of actively managed health care funds like the Simplify Health Care ETF can potentially enhance overall portfolio performance, offering a compelling blend of stability, growth, and responsiveness to market changes. As we look to the future, the macroeconomic and strategic logic for including health care in investment portfolios becomes increasingly persuasive, ensuring that investors are well-positioned to capitalize on the sector's dynamic opportunities.

For more information on PINK, including our partnership with Susan G. Komen to donate all profits from the fund to the fight against breast cancer, please visit the PINK fund page.

View PINK Fund Insights Video Recap