Simplify 101

What is Convexity?

Definition

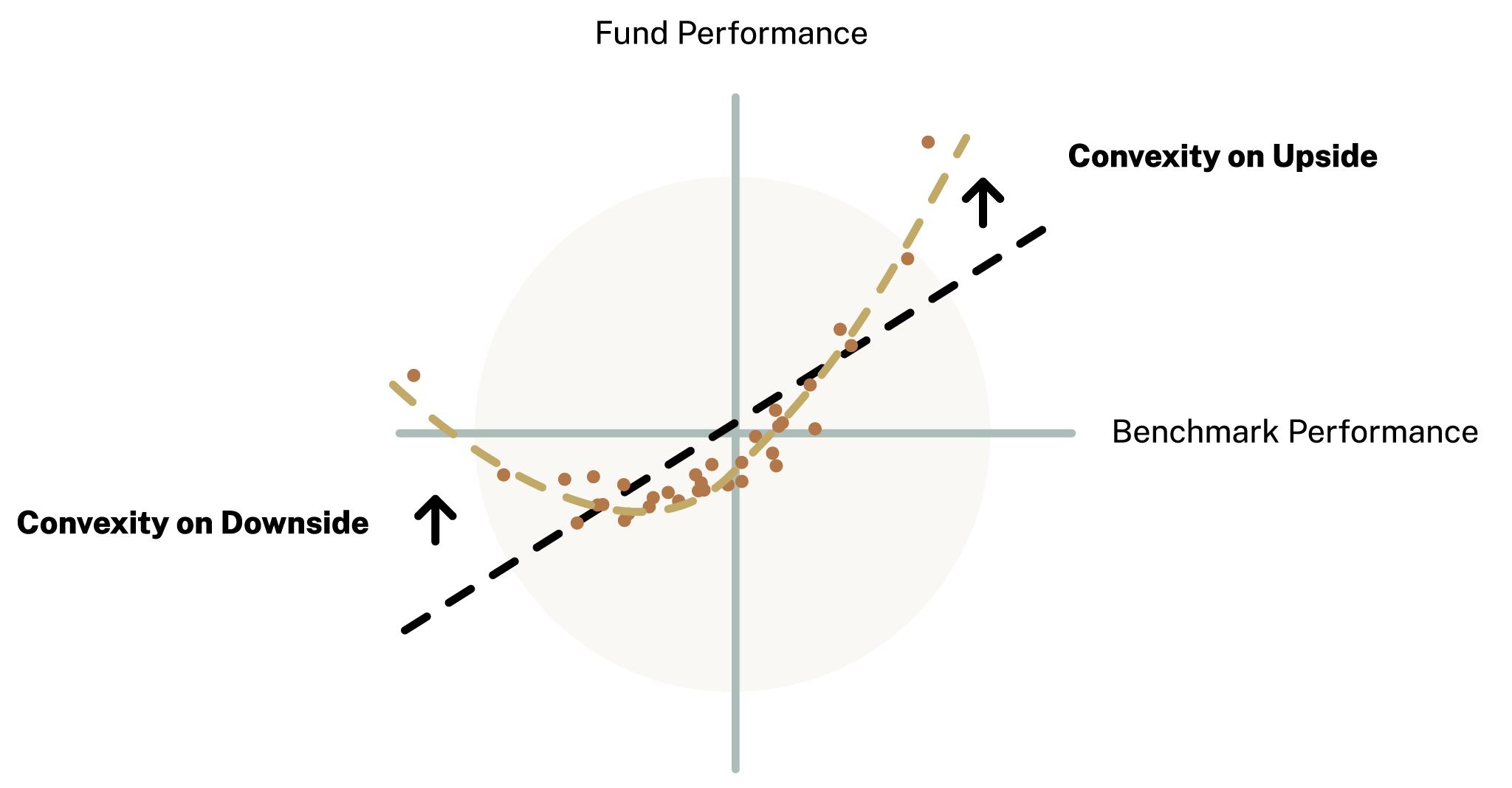

An investment strategy is convex if its payoff relative to its benchmark is curved upward. The image below depicts an investment strategy that exhibits convexity on both the downside and the upside. Convex investment strategies are expected to be highly correlated with the benchmark in typical market environments but diverge to the positive in extreme markets. There are no free lunches though, and convex strategies are expected to lag during quiet markets.

The Benefits of Convexity

Convexity can help investors with protection and performance.- Protection Downside convexity is a powerful way to protect capital against deep market drawdowns and can be deployed either strategically or tactically. Protection via convexity is designed to increasingly support your portfolio as a market drawdown worsens, covering you when you need it most.

- Performance Upside convexity is beneficial for those investors who don’t want to miss out on the biggest of market moves, and similar to downside convexity, can be deployed either strategically or tactically. It is a valuable tool for those investors looking to enjoy the benefits of strong moves up while not committing excessive capital to risky assets or deploying outright leverage.