Fixed Income

Fixed Income

Efficient Credit Hedging With the Quality-Junk Factor

Introduction

The extraordinary credit crisis that emerged in the mortgage market in 2007-2008 introduced the investment world to the concept of credit hedging and the potential for asymmetric returns in financial products like Credit Default Swaps (CDS). Unfortunately, enthusiasm for these trades, regulatory changes, and policy responses changed the available payoff profiles in credit hedges. As a result, investors have been relentlessly disappointed with credit hedging techniques, even as the return potential in credit has declined with tight credit spreads and low risk-free yields.The high cost and disappointing performance of credit hedging leave investors with a quandary – how, if at all, can credit risk be hedged efficiently? This blog shows how a long-short exposure to the quality-junk factor (Q-J) can potentially function as an efficient credit hedge within a costly hedging space.

Theory Behind Credit Hedging with the Quality-Junk Factor

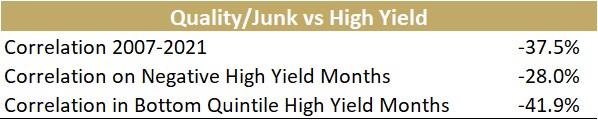

In 1974, Robert Merton introduced the “Merton Model” of credit and equity as competing claims on underlying asset value. In this model, equity can be thought of as a call option on the value of total firm assets above the notional (face value) level of debt, as depicted in Figure 1.Figure 1: Merton's Model of Equity as a Call Option

As many academics and practitioners have noted, this relationship introduces the potential to model credit exposures and credit hedges as options as well. For example, the creation of Credit Default Swaps (CDS), made famous in Michael Lewis' book, The Big Short, relied on these insights to create the equivalent of a call option on credit default risk.

The Merton model naturally leads to an alternative to using CDS to obtain credit hedging properties – an equity long/short expression that pairs a long in high quality, low leverage equities with a short in low quality, high leverage equities. The quality equities are essentially deep-in-the-money calls (on asset value), while the junk equities are at-the-money calls, creating an asymmetric response from the long/short portfolio when a risk-off event occurs and asset values drop below debt face values for the junk names.

Let's now take a look at this empirically

The Quality-Junk Factor in Practice

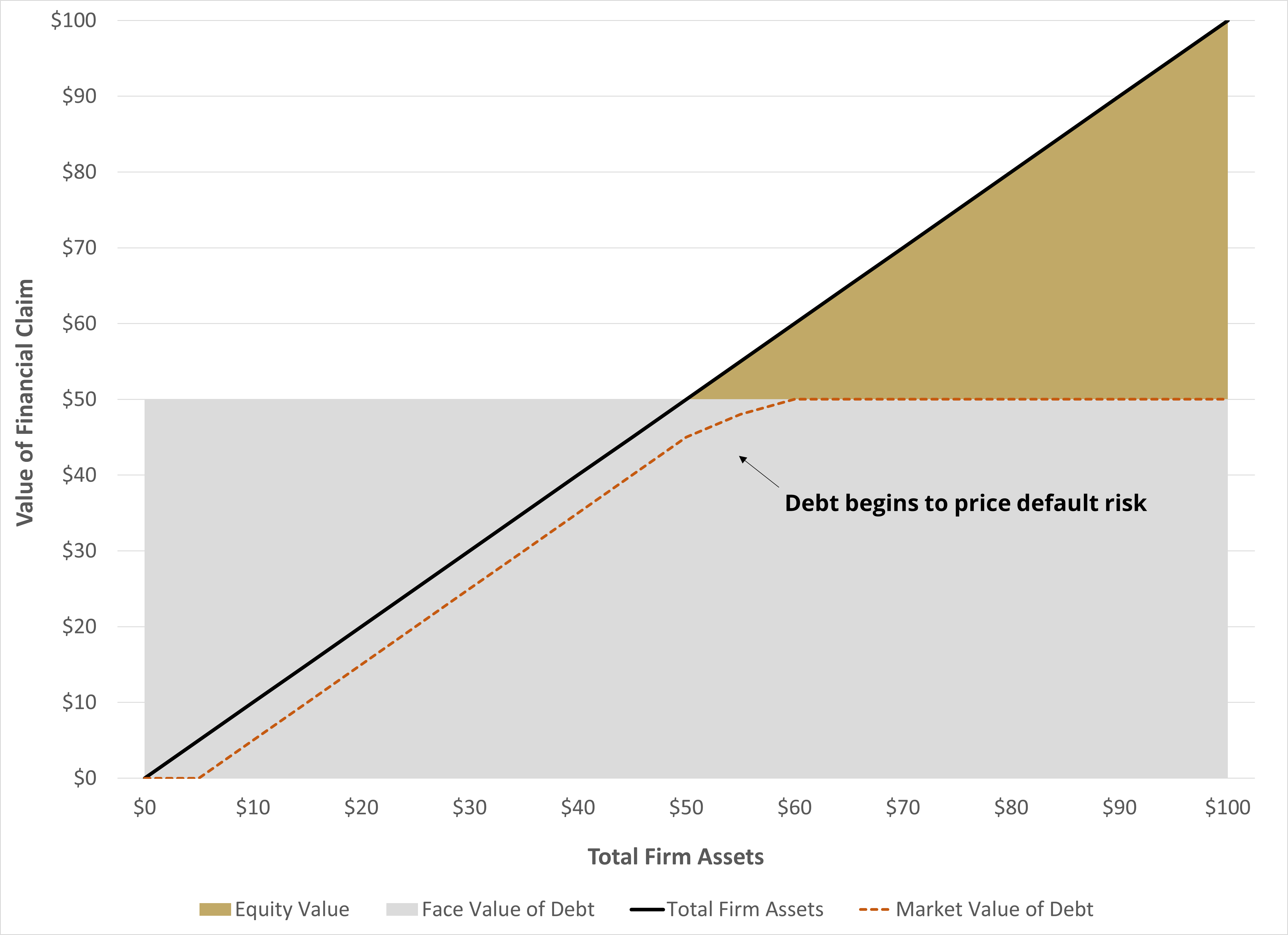

We create our quality basket by screening for the highest decile of names by margins, profit stability, and balance sheet strength from the 1000 most liquid stocks and enforcing equal-weight sector exposures. We then create a junk basket from the same 1000 names, again with sector limits, screening for the highest decile of sensitivity to an increase in debt refinancing costs. These legs don’t mirror each other from a characteristics perspective on purpose; we do not want to overweight a single factor causing excessive volatility in the hedge. Our Q-J portfolio is then 100% long Q and 70% short J, to stay near beta-neutral. This configuration is also relatively sector-neutral, helping avoid unintended basis risk through extreme allocations to any given sector.From the lens of the above screening criteria, the prediction that Q-J should act as a credit hedge seems intact: the long Q position has low sensitivity to financing costs (credit spreads) while the short J has a high sensitivity to widening credit spreads. In Figure 2, we show hypothetical performance for this definition of Q-J compared to high yield markets using a hypothetical data for the baskets described above. As expected, we see strong outperformance during risk-off periods, precisely acting like a credit hedge. In addition, we also see a very positive carry outside of the risk-off events, an incredibly beneficial feature for a credit hedge in low-yield environments.

Figure 2: Hypothetical Q-J vs High Yield

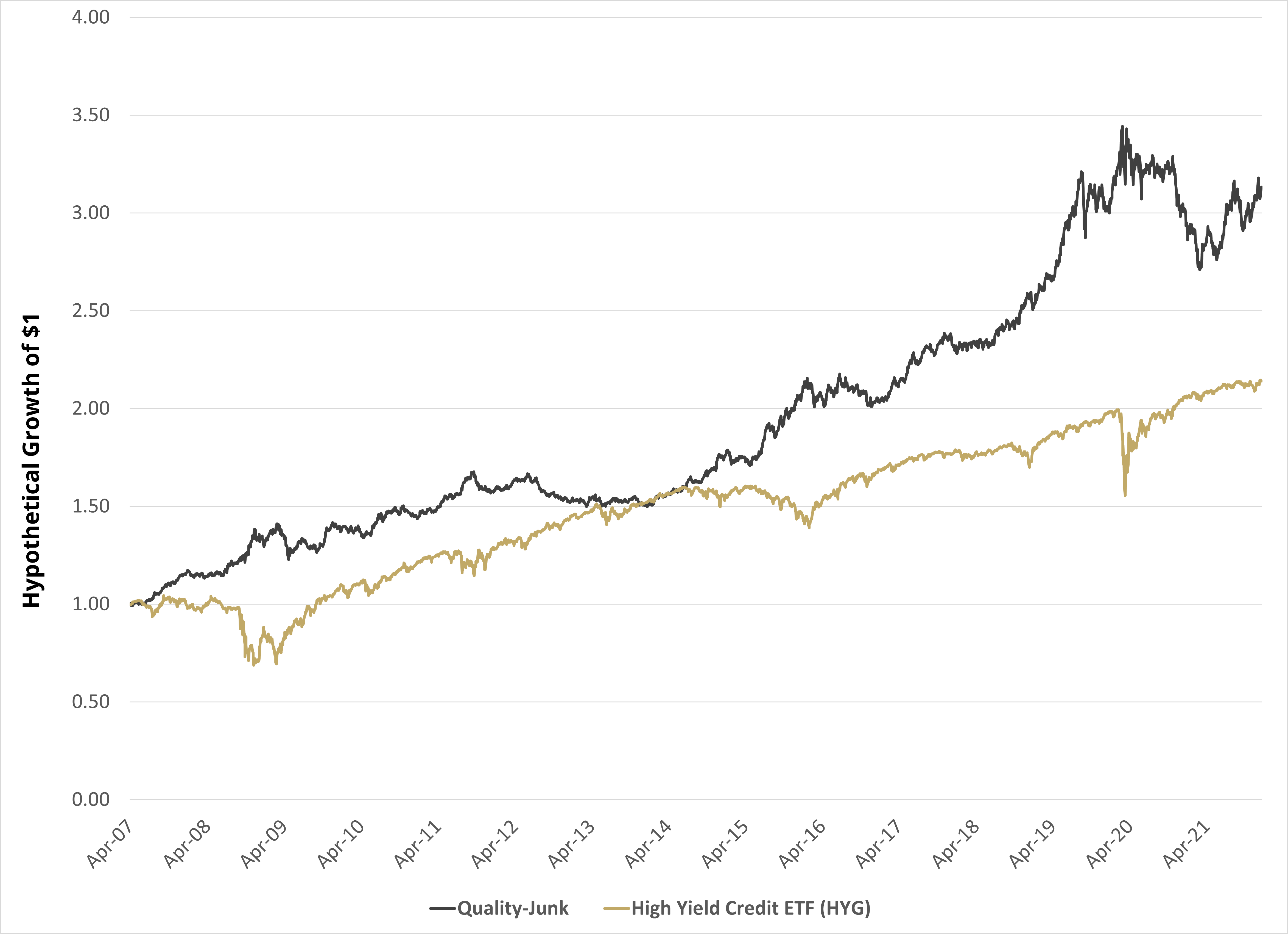

Figure 3: Q-J Conditional Correlations to High Yield