Summary

- The 60/40 portfolio (60% stocks/40% bonds) is the most enduring asset allocation framework in modern investing, and it has only two key objectives: growth and diversification.

- Two critical assumptions underlying this framework are negative stock/bond correlations and a sufficient return from bonds. These assumptions may no longer be valid, calling into question whether the two-asset portfolio should be recommended going forward.

- Introducing a third asset class — alternatives — to portfolio construction may improve both absolute and risk-adjusted returns while addressing the new macro backdrop.

Objects in the Mirror May Be Less Effective Than They Appear

Traditional portfolios have historically been built with two main assets: stocks and bonds. This combination sought to optimize for risk-adjusted returns while balancing prudent long-term growth of capital. These portfolios were recommended nearly 100 years ago with the introduction of the first balanced mutual fund, the Vanguard Wellington Fund, in 1929.

Today, these stock and bond portfolios, in the form of target date funds, are the default savings vehicles in defined contribution savings plans, with over $4 trillion in assets.* In addition, the stock/bond portfolio mix is the basis of nearly every single asset allocation recommendation offered by financial institutions.

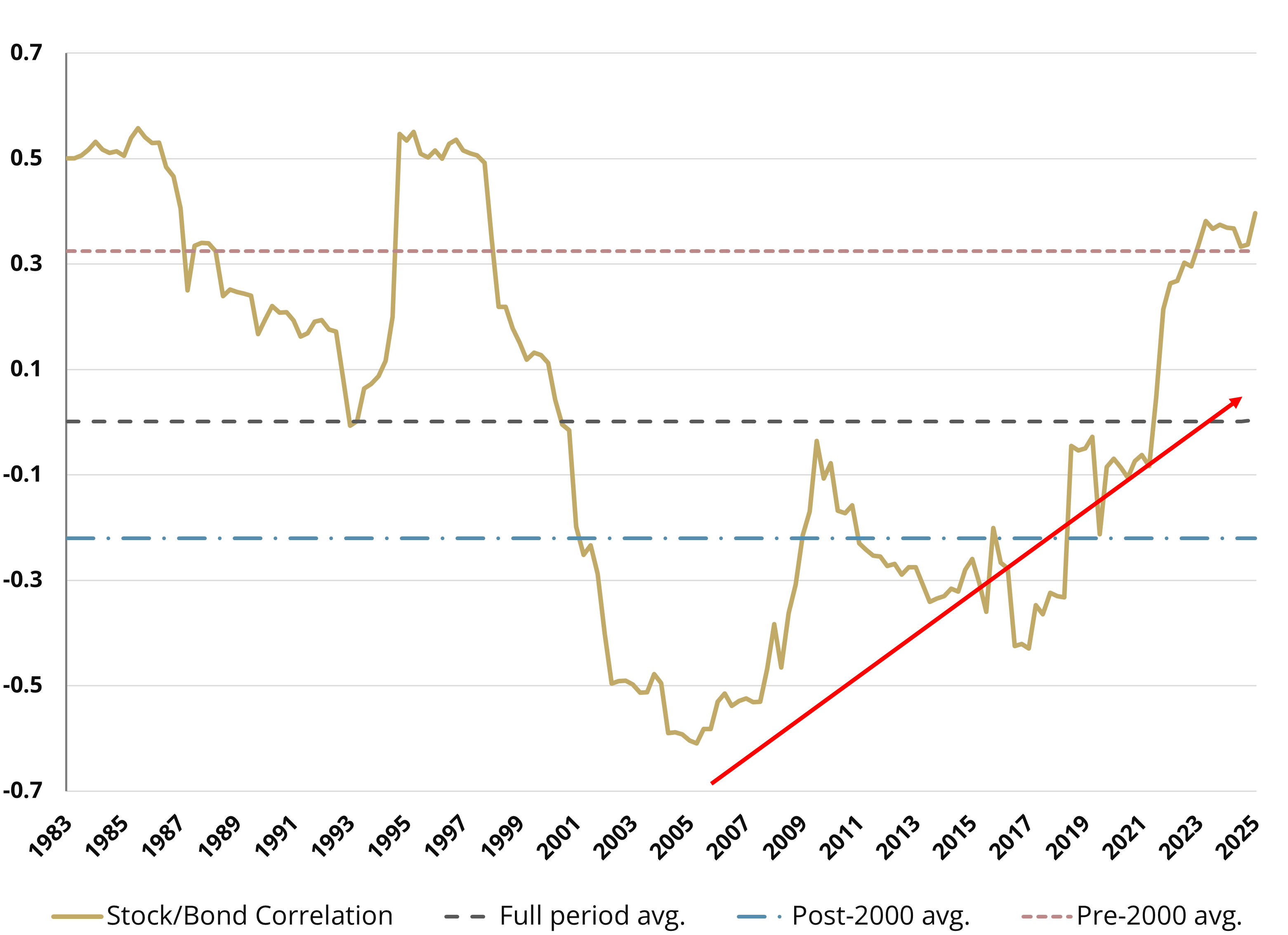

While this approach worked reasonably well for forty years, 2022 served as an important wake-up call for those still tethered to the simplistic 60/40 portfolio. The correlation between stocks and bonds broke firmly into positive territory in early 2022, after having risen for nearly twenty years. And this correlation has only continued to increase since then.

Figure 1: Correlation of Stocks and Bonds

(09/30/83 - 09/30/25)

As we saw in 2022, when both stocks and bonds declined together, the two-asset portfolio of yesteryear can be quite vulnerable without the anti-correlation benefits.

Modernizing the Traditional 60/40 Portfolio

The three components of a modern approach to a balanced portfolio can be thought of as stocks, bonds, and alternatives.

- Stocks represent participation in growth — earnings growth, economic growth, or simply the growth in human advancement.

- Bonds are a lower-volatility asset that can add diversification benefits, particularly during recessionary or crisis periods.

- Alternatives may lower portfolio volatility while maintaining high growth potential by adding a source of potentially attractive returns that is independent of stocks and bonds.

While there are strategies that can be used to optimize the allocation to stocks, one of the most impactful steps towards modernizing a 60/40 portfolio begins with improving the diversifiers (alternatives and bonds). That’s because the performance of the traditional bond allocation, in terms of returns as well as diversification benefits, is such a low hurdle to overcome.

Two steps can be considered to improve the diversifiers:

Add assets with low correlations to both stocks and bonds, providing a third leg that can improve a portfolio’s stability.

Add securities that can potentially improve the performance of the bond allocation while maintaining similar characteristics.

Step 1: Add a Third Leg to a Portfolio with Alternatives

Bonds can be an effective diversifier to stocks… some of the time. But even when stocks and bonds are negatively correlated, the portfolio is not as reliable as it could be. Think of it as a two-legged stool. That’s certainly more stable than a one-legged stool, but not something that most people would want to rely on.

Adding a true third leg to the stool would mean an asset that not only had a low correlation with stocks, but with bonds as well.

Enter managed futures. Managed futures funds take long or short positions in a variety of futures contracts across commodities, interest rates, and — for some funds — equities and currencies.

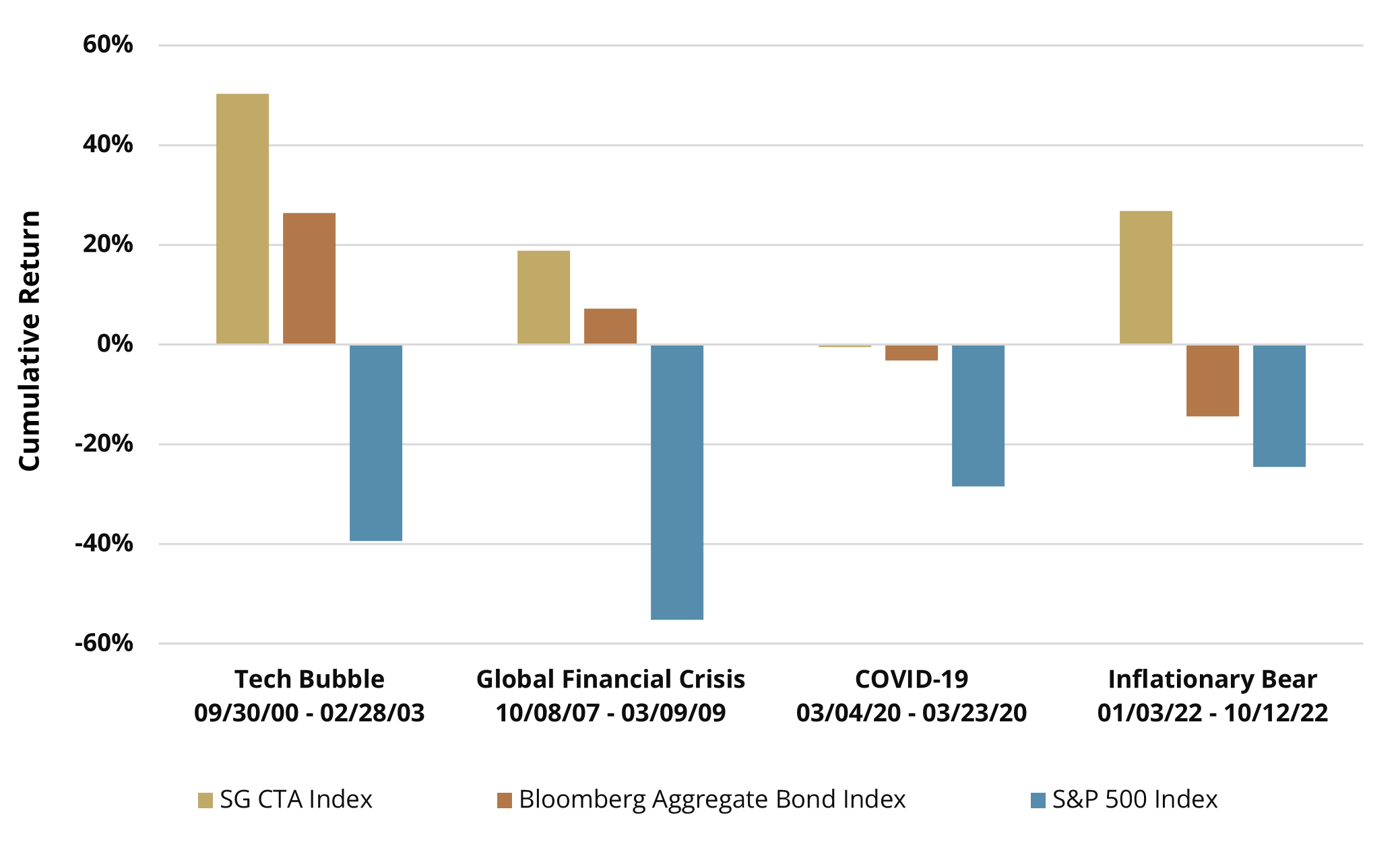

Due to the introduction of commodities, as well as the ability to go long or short, managed futures funds have historically had low correlations with both stocks and bonds. More importantly, they have historically performed at their best when stocks were undergoing severe drawdowns.

Figure 2: Performance of Managed Futures During Equity Drawdowns

CTA: Simplify Managed Futures Strategy ETF

CTA aims for long-term capital growth by systematically investing in futures seeking to generate absolute returns with low equity correlation, offering support during risk-off events.

It takes long or short positions in 30+ commodity and interest rate futures contracts. At its core is a systematic trend-following algorithm that seeks to identify which contracts to take positions in, which direction (long or short), and in what size.

In addition to the primary trend model, it utilizes additional models designed to assist performance in periods when trend following is most vulnerable. For example, if a contract’s performance is extreme to the upside, the trend following model would indicate taking a large, long position. However, the fundamental-reversion model seeks to identify when a trend becomes overextended and thus would reduce the position size.

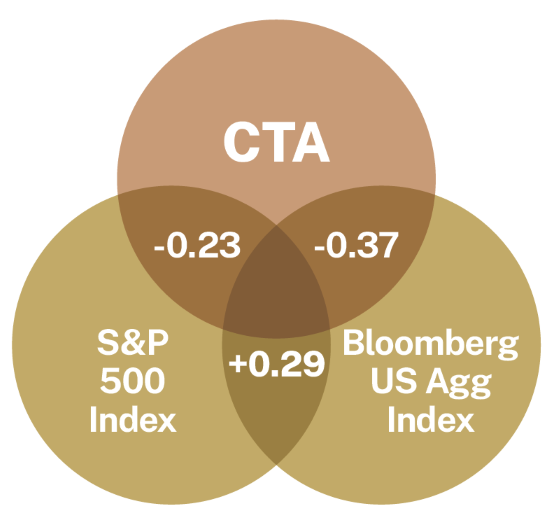

Since its March 2022 inception, CTA has maintained a negative correlation with both stocks and bonds, making it a powerful tool to add to the diversifier sleeve.

Figure 3: CTA’s Correlation with Stocks and Bonds Since Inception

Step 2: Bonds…but Better

The default bond allocation in many traditional portfolios is deployed in bond index funds, typically tied to the Bloomberg Aggregate Bond Index or the Bloomberg Universal Bond Index. Devoting a portion of the bond allocation to an actively managed fund has the potential to add incremental returns.

Bond indices are largely misunderstood. It’s natural to assume they are constructed similarly to stock indices, but that’s not the case.

Market cap-weighted stock indices are an expression of the collective wisdom of the entire universe of investors. If Nvidia reports strong results, there will be more buyers than sellers, which drives up the stock price. This collective market action is hard to beat, which is why most actively managed equity funds underperform their benchmark indices.

Bond indices, on the other hand, are not an expression of the market’s collective wisdom. They are the result of market issuance. The bigger the borrower, the greater percentage of the index they represent. That’s why U.S. Treasury securities comprise such a large percentage of the Bloomberg Aggregate Bond Index. It’s not because investors have collectively decided that U.S. Treasuries are the most attractive securities. It’s because the U.S. federal government runs growing budget deficits, which are, in turn, financed by issuing more debt.

Against this backdrop, active managers in the fixed income space have more opportunities to add value versus their respective indices.

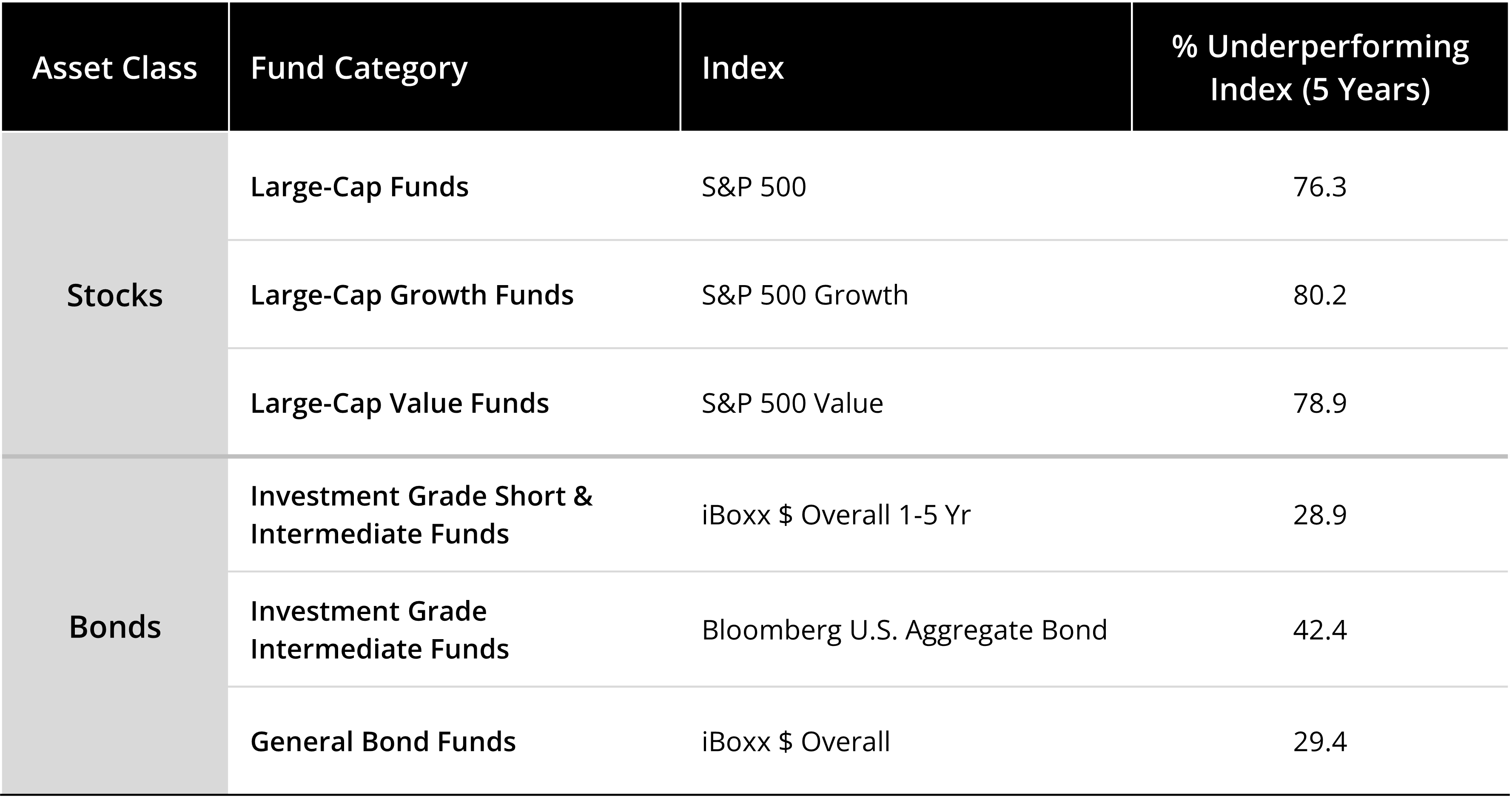

Figure 4: Percentage of Funds Underperforming Benchmark Indices

5 Years Ended 2024

Not surprisingly, over the past five years, most actively managed stock funds have underperformed benchmark indices. In contrast, most bond funds have outperformed their benchmark indices. If not for a large number of funds with high expense ratios, this number would have been even higher.

AGGH: Simplify Aggregate Bond ETF

AGGH seeks to outperform the Bloomberg US Aggregate Bond Index in both yield and total return through an active management strategy. The three pillars of the strategy include:

- Targeting bonds with the highest yield without increasing credit risk. For example, overweighting Treasury Inflation-Protected Securities (TIPS) or mortgage-backed securities when they are historically attractive versus treasuries.

- Using treasury futures contracts to target the most favorable point on the yield curve and set the fund duration.

- Seeking to enhance yield through a risk-managed treasury options selling strategy. Treasury options can deliver attractive premiums due to the structural options demand from dealers.

The Modern Balanced Portfolio Revealed

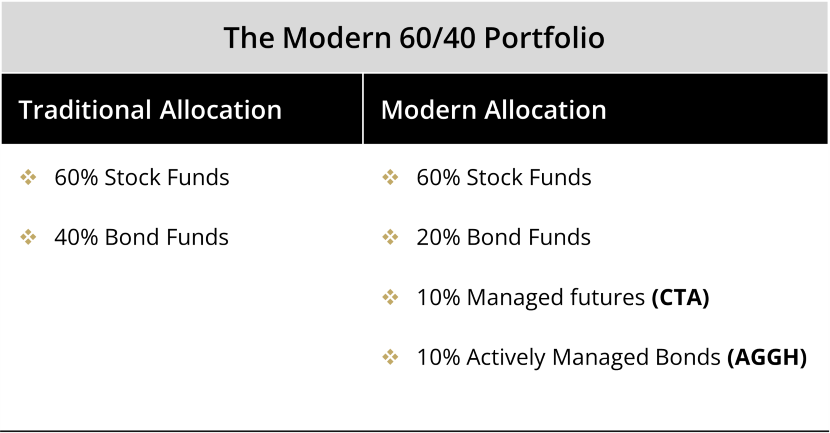

Putting steps 1 and 2 together, we arrive at an allocation that seeks to improve traditional stock/bond allocations in both absolute returns and lowering portfolio volatility and drawdowns.

Conclusion

The traditional 60/40 portfolio can be viewed as the original frontier of diversification, having been recommended to investors for nearly one hundred years. Since that time, there have been incredible advancements in science, technology, medicine, sports, and every other human endeavor. Yet while humanity has leaped forward, the 60/40 portfolio remains frozen in time.

Today’s investors have many more tools available to them than they did in 1929. So many tools, in fact, that modernizing a traditional stock/bond portfolio can be a daunting task. Rather than attempting a wholesale replacement of an entire portfolio all at once, we believe that an effective first step is to make a couple of adjustments to the 40, or the diversifying sleeve of the portfolio.

A managed futures ETF like CTA can add a critical third leg to a portfolio, effectively diversifying both the stock and bond portions of the portfolio, while an actively managed bond ETF like AGGH can potentially increase returns from your bond sleeve.

*Source: investmentnews.com, 09/03/25.

GLOSSARY

Bloomberg Aggregate Bond Index: Is a widely followed benchmark that measures the performance of the U.S. investment-grade bond market. It includes Treasury, government-related, corporate, and mortgage-backed securities, providing a comprehensive representation of the broad bond market. Investors and fund managers use the index to track market trends, assess portfolio performance, and guide investment strategies across fixed-income securities.

Bloomberg US Aggregate Bond Index: A broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Bloomberg Universal Bond Index: Is a broad benchmark that tracks the performance of investment-grade bonds globally, including government, corporate, and securitized debt across multiple currencies. It provides investors with a comprehensive view of the global fixed-income market, helping to evaluate portfolio performance, manage risk, and guide investment strategies across diverse bond markets.

Expense Ratio: Determined by dividing a fund's operating expenses by the average dollar value of its assets under management (AUM).

Futures Contract: A legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange.

iBoxx $ Overall Index: Is a benchmark that tracks the performance of U.S. dollar-denominated investment-grade corporate bonds across various sectors and maturities. It provides a comprehensive measure of the U.S. corporate bond market, helping investors assess portfolio performance, monitor market trends, and guide fixed-income investment strategies.

iBoxx $ Overall 1–5 Yr Index: Tracks the performance of U.S. dollar-denominated investment-grade corporate bonds with maturities between 1 and 5 years. It provides investors with a focused measure of the short- to intermediate-term corporate bond market, helping to assess portfolio performance, manage interest rate risk, and guide fixed-income investment strategies.

Long or Short Positions: A long position involves buying a financial asset with the expectation that its price will rise, generating a profit if the asset’s value increases above the purchase price. Conversely, a short position involves selling an asset you do not own, usually borrowed, expecting its price to fall so it can be repurchased at a lower price for a profit. Both terms represent opposite investment strategies based on anticipated price movements.

Managed Futures: An investment where a portfolio of futures contracts is actively managed by professionals. Managed futures are considered an alternative investment and are often used by funds and institutional investors to provide both portfolio and market diversification.

Mortgage-Backed Securities (MBS): Investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them. Investors in mortgage-backed securities receive periodic payments similar to bond coupon payments.

SG CTA Index (SocGen CTA): Provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). Calculates the net daily rate of return for a group of 20 CTAs selected from the largest managers open to new investment. The SG CTA Index is equal-weighted and reconstituted annually and has become recognized as the key managed futures performance benchmark.

S&P 500 Index: The index includes 500 leading U.S. large cap companies and captures approximately 80% coverage of the available market.

S&P 500 Growth Index: Tracks the performance of stocks within the S&P 500 that exhibit above-average growth characteristics, such as higher earnings growth and revenue expansion. It provides investors with a benchmark for assessing the performance of growth-oriented equities in the U.S. large-cap market and helps guide investment strategies focused on capital appreciation.

S&P 500 Value Index: Composed of companies from the broad-based S&P 500 Index that are considered to be value stocks.

Structural Options: Are derivative instruments embedded within a financial product that give the holder the right, but not the obligation, to take specific actions under predefined conditions. They are designed to manage risk, enhance returns, or provide flexibility in investment strategies, often linked to underlying assets such as stocks, bonds, or indices. Structural options allow investors to tailor exposure and adjust the payoff profile according to market movements.

Treasury Inflation-Protected Securities (TIPS): A type of Treasury security issued by the U.S. government. TIPS are indexed to inflation to protect investors from a decline in the purchasing power of their money.

Treasury Futures Contracts: Standardized agreements to buy or sell U.S. Treasury securities at a specified price on a future date. They are used by investors and institutions to hedge interest rate risk, speculate on changes in Treasury yields, or manage portfolio duration. These contracts are traded on regulated futures exchanges and provide a liquid and transparent way to gain exposure to U.S. government debt instruments.

Treasury Options: Financial derivatives that give the holder the right, but not the obligation, to buy or sell U.S. Treasury securities or Treasury futures at a predetermined price on or before a specified expiration date. They are commonly used to hedge interest rate risk, manage portfolio exposure, or speculate on movements in Treasury yields. Treasury options provide flexibility and leverage while allowing investors to tailor risk and return profiles based on market expectations.

Volatility: A measure of how much and how quickly prices move over a given span of time.