Introduction

Only launched recently, we believe the Simplify Barrier Income ETF (SBAR) is already exceeding expectations by delivering the high income and operational simplicity that today’s investors demand. By transforming the investment industry's popular, trillion-dollar structured note concept into an ETF wrapper, SBAR offers a more liquid and cost-effective approach to enhanced equity income. This breakthrough structure eliminates many of the complexities and inefficiencies of traditional structured notes, providing daily liquidity, greater transparency, and streamlined portfolio integration. In this blog post, we’ll explore SBAR’s compelling monthly distribution rates, total returns, and powerful operational advantages it offers both seasoned structured note users and investors discovering these strategies for the first time.

High and Consistent Income

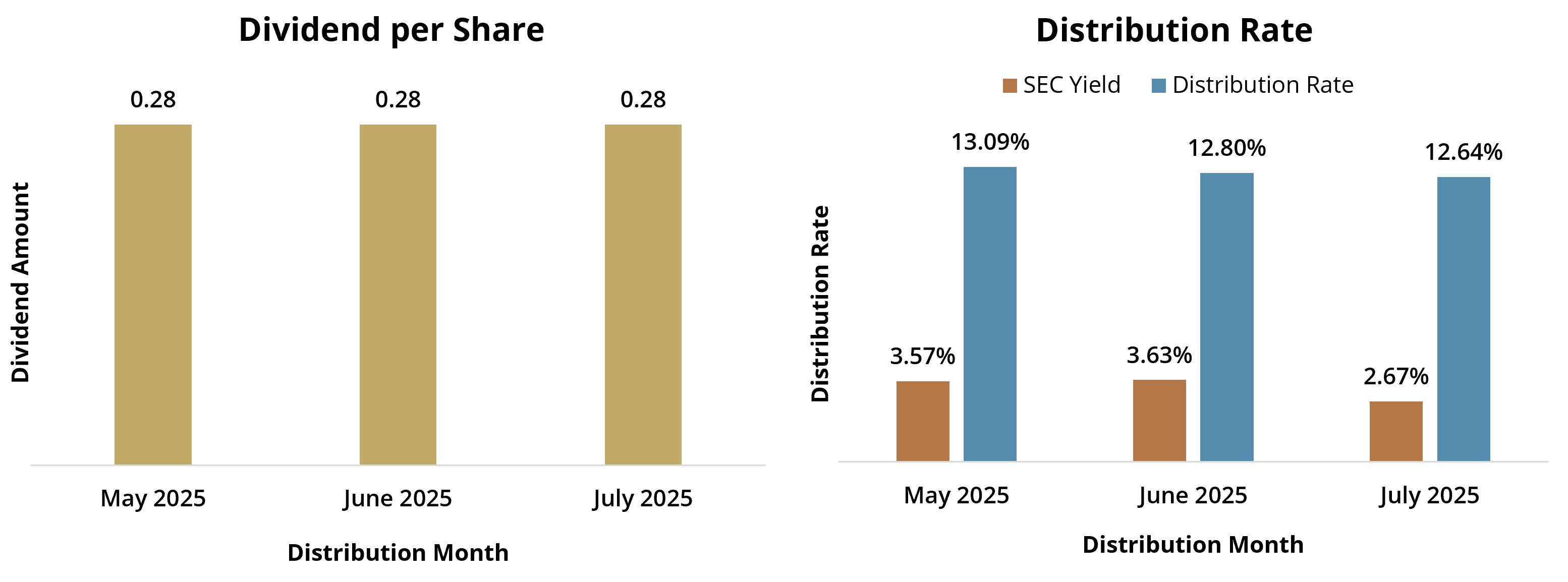

SBAR offers a differentiated source of equity income designed to deliver consistent monthly distributions, providing investors with reliable cash flow to support a range of income objectives. The strategy’s income is primarily driven by premiums from barrier option positions. Figure 1 illustrates the three distributions paid since inception, along with their corresponding distribution rates. It is worth noting that the distribution rate has modestly declined over time, due to the relaxation of vols from extreme highs.

Figure 1: SBAR’s Dividend and Distribution Rate

Total Returns

Since its inception on April 14, 2025, through July 31, 2025, SBAR has delivered a strong total return of 7.95%, driven largely by rising equity markets and frequent auto-calls. Nearly all initial positions have been called early, accelerating income realization for investors.

SBAR’s net asset value (NAV) stability is further supported by its strategy of selling put options with a 30% barrier below current index levels. As equity markets advance, these strike prices move further out of the money, increasing the likelihood of positions being auto-called and allowing option premium to be “stacked” for future income. This structural design not only helps to enhance yield potential but also improves income predictability, thus making SBAR a compelling solution for investors seeking stable, equity-linked monthly distributions.

Figure 2: SBAR Total Return Since Inception

Benefit From Operational Efficiency

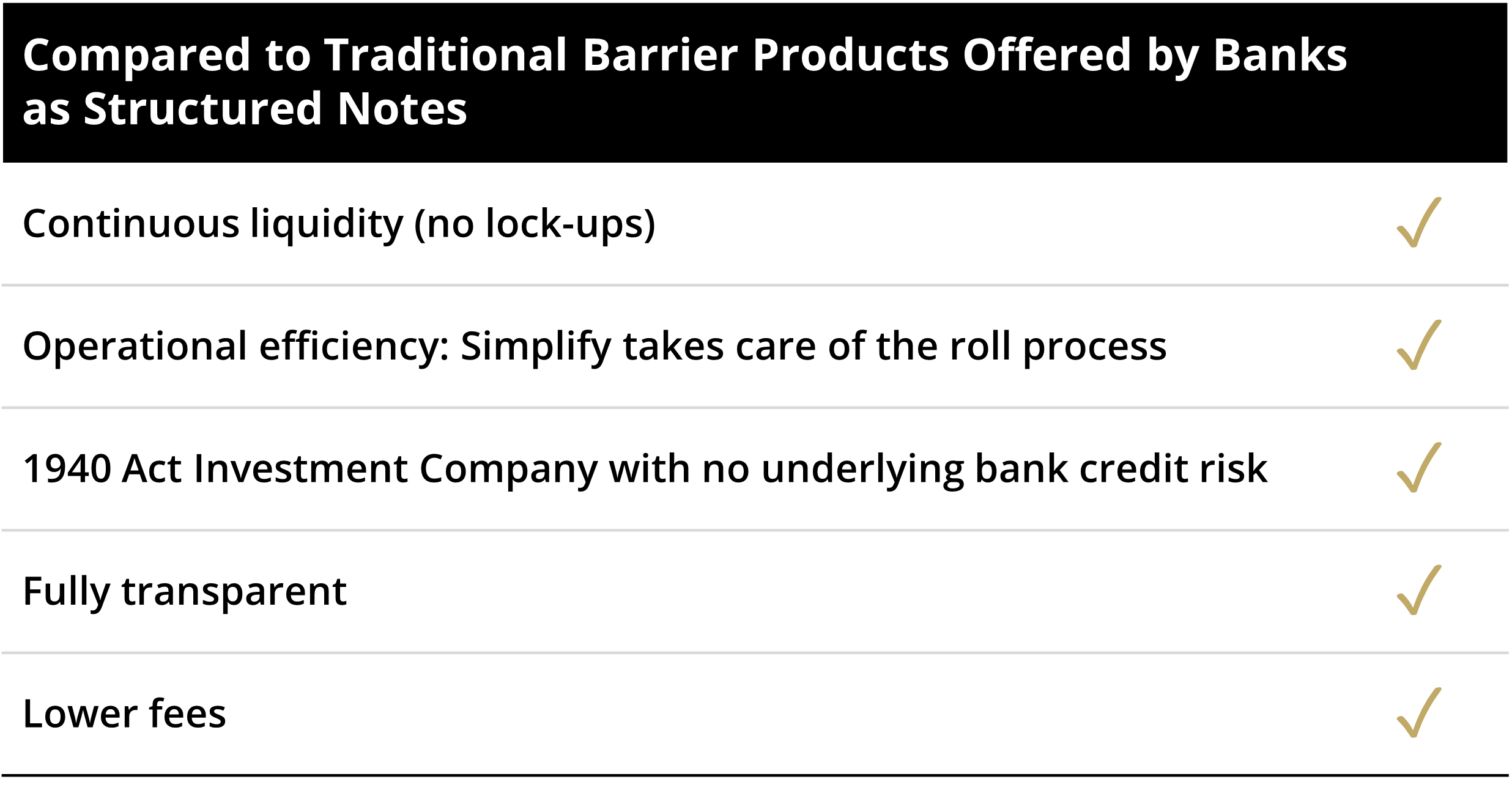

Whether you're well-versed in structured notes or exploring them for the first time, Simplify’s Barrier ETFs provide a more operationally efficient alternative to traditional structured notes by eliminating key constraints that may often burden investors. With continuous liquidity and no lock-up periods, investors can enter and exit positions with ease, unlike traditional notes that may have rigid holding requirements. Professional rolling ensures seamless portfolio management, removing the complexity of manually reinvesting in new structures. Additionally, Simplify Barrier ETFs eliminate bank credit risk, offering exposure without reliance on issuer solvency. The fully transparent structure, lower fees, and avoidance of K-1 tax forms further enhance investor convenience. We believe this makes these ETFs a cost-effective and streamlined solution for accessing structured product benefits. Figure 3 highlights the operational burden removed by Simplify’s structured product offerings:

Figure 3: Operational Efficiencies Gained by Simplify’s Approach

In Conclusion: A Smart Approach to Structured Income

We believe SBAR represents the future of structured income investing by offering all the benefits of traditional structured notes while reducing the drawbacks that have historically limited their appeal. With high income level potential, robust NAV performance, and innovative operational simplicity, SBAR gives investors a compelling tool to help enhance equity income in a more efficient and accessible format. Whether you are a seasoned structured note investor or new to the space, SBAR seeks to deliver a sophisticated strategy in an investor-friendly ETF wrapper. This is not just an innovation, it’s the natural evolution of income investing.

GLOSSARY

Autocall: A type of structured product feature that automatically redeems (or “calls”) the investment before maturity if certain market conditions are met, such as the underlying index or asset trading above a specified level on an observation date.

Barrier Option: A type of customized over-the-counter option in which the underlying reference assets, tenor and barrier level are negotiated with a counterparty. They set a threshold (“barrier”) below which the underlying notional value is fully exposed to the downside upon expiration.

Distribution Rate: The measurement of cash flow paid by an exchange-traded fund (ETF), real estate investment trust, or another type of income-paying vehicle. Rather than calculating the yield based on an aggregate of distributions, the most recent distribution is annualized and divided by the net asset value (NAV) of the security at the time of the payment.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day. Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

Out of the Money: An option has no intrinsic value, only extrinsic or time value.

SEC 30-Day Yield: The yield is calculated with a standardized formula and represents net investment income earned by a fund over a 30-day period, expressed as an annual percentage rate based on the fund's share price. The yield includes the effect of any fee waivers and/or reimbursements. Without waivers, yields would be reduced. This is also referred to as the "standardized yield", “30-Day Yield” and “Current Yield”. The unsubsidized SEC 30-Day Yield does not reflect the effect of any fee waivers and/or expense reimbursements.

Structured Note: A debt obligation that also contains an embedded derivative component that adjusts the security's risk-return profile.