Fixed Income

Fixed Income

Can Futures-Based Bond Funds Improve Tax Efficiency?

Introduction

Utilizing futures to replicate fixed income exposure may offer investors structural advantages including enhanced yields and capital efficiency. As discussed previously in Efficient Long Duration Treasury Investing, targeting fixed income exposure via futures may provide higher yields, while simultaneously minimizing volatility and other curve risks. In addition, the ability to deliver full duration exposure without having to outlay the full notional amount of the futures position, provides for capital efficiency freeing up capital for use in other asset classes. A third consideration, and potential benefit, is the tax efficiency of futures relative to cash-based bond funds. In this article, we explore the potential tax benefits of utilizing futures as a building block for fixed income investing.

Review of U.S. Tax Code

To start, a brief refresher on the tax treatment of futures contracts may be of benefit. Futures contracts are covered under Section 1256 of the Internal Revenue Code[1] which states that any futures contract traded on a U.S. exchange will be taxed at 60% of one’s long-term capital gains rate and 40% of one’s short-term capital gains rate, regardless of how long the contract was held. Even if one does not trade his or her futures contract position, it will be marked to market in that calendar year, and both realized and unrealized gains and losses will be reported. Using the current maximum marginal long-term capital gains rate of 20% and the maximum marginal short-term capital gains rate of 37%, this implies a maximum marginal total tax rate of 26.8% on futures contracts.

By comparison, owning a bond outright may provide investors with both price appreciation (taxed at either long or short-term capital gains rates, depending on the holding period), as well as regular distributions taxed at ordinary income tax rates. In this blog we are concerned with fixed income funds, but for any fund organized as a corporation, such as mutual funds and exchange traded funds, the underlying tax consequences are imputed directly to the owners of the fund, hence the above assumptions directly apply. Finally, depending on the amount of turnover in the fund and the extent to which the fund manager is able to implement so-called heartbeat trades the price appreciation in the fund may be deferred until the investor closes out their position in the fund.

We encourage all readers to consult with a tax professional on all tax related matters, as the specifics of one’s individual tax situation will affect the tax treatment of one’s investments.

Tax Comparison

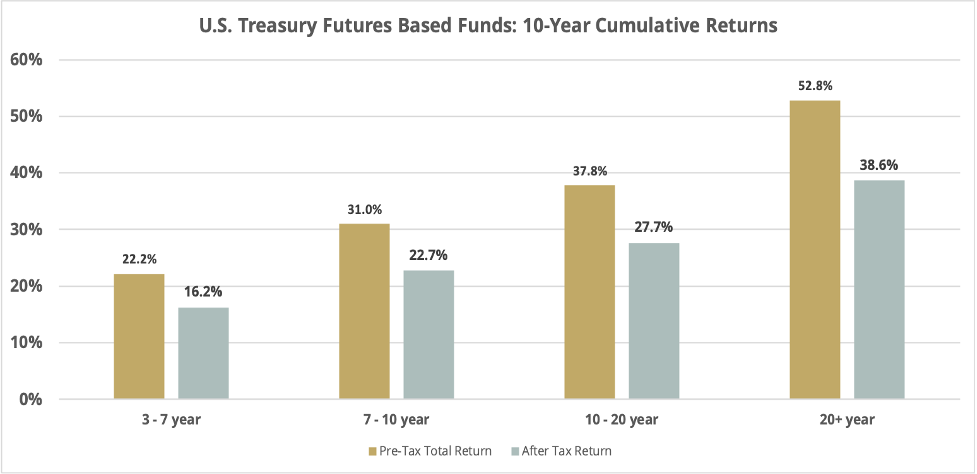

For our analysis, we made some simplifying assumptions to illustrate an apples-to-apples comparison between the after-tax returns to an investor owning a futures-based fund versus a bond-based fund over a 10-year investment horizon ending on 9/30/2021.

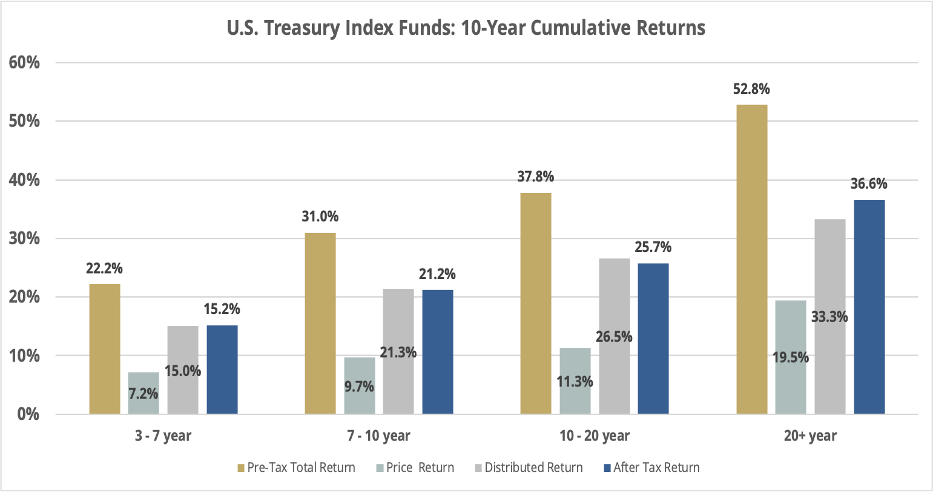

To start, we evaluated the 10-year return history of four passively managed U.S. Treasury exchange traded funds which seek to track the investment results of an index composed of U.S. Treasuries. These four funds[2] had varying maturities of 3-7 years, 7-10 years, 10-20 years, and 20+ years. For each of these funds, we decomposed their respective 10-year cumulative pre-tax total returns into a price return component and an income return/distribution component.

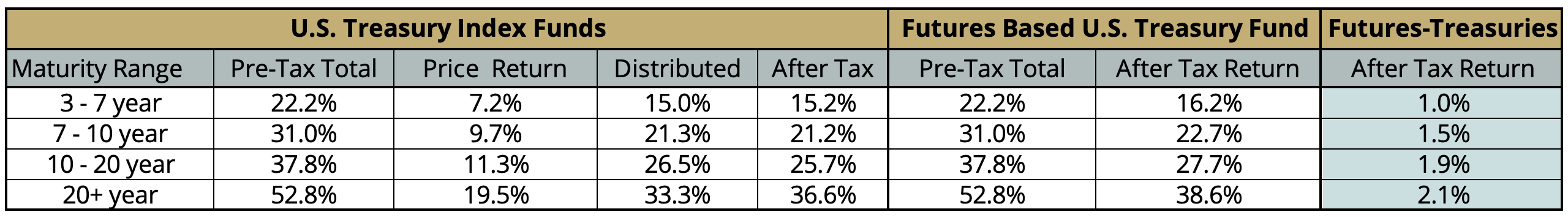

For the price return component, we assumed a 20% long-term capital gains tax rate applies. That is we assume that all of the price appreciation is given the most favorable, long term capital gains treatment (i.e. 100% deferral of capital gains on any price appreciation, and capital gains are only realized at the end of the holding period). For the income return/distribution component, we assumed a 37% income tax rate applies. Figure 1 shows the 10-year pre-tax return, price return, income/distribution return, and after-tax return for each of these four bond funds as of Sept. 30, 2021.

Figure 1 – U.S. Treasury Index Funds: Pre-Tax Total Return, Price Return, Distributed Return, and After-Tax Return, 9/30/11 – 9/30/21

To summarize, Figure 3 shows the comparative advantages of using a futures-based U.S. Treasury fund versus a similar cash-based fund. In our analysis, we found that, hypothetically, utilizing a futures-based fund to obtain U.S. Treasury exposure could result in “tax-alpha” of anywhere from 104 to 207 basis points over a 10-year period. This illustrative tax-alpha can primarily be attributed to the unique tax treatment afforded to futures-based fixed income strategies afforded by Section 1256 of the Internal Revenue Code.

Figure 3 – U.S. Treasury Cash-Based Bond Funds vs. Futures-Based Fund, 9/30/11 – 9/30/21

Of note, this is a hypothetical comparison. In reality, one would want to consider other factors including, but not limited to:

● The unique tax circumstance of each investor

● Potential fee differences between futures-based and cash-based bond index funds

● Knowledge of and comfort level with futures-based investments

As always, we recommend consulting with your tax and other professional advisors on any and all investment and tax related matters.

Parting Words

Today, we find ourselves in a unique environment where futures-based fixed income strategies are easily accessible, low-cost, and transparent. Tax laws are always evolving and there are currently proposals being discussed to increase the long-term capital gains rate. As such, we believe careful consideration of potential tax consequences should be a part of an investor’s decision-making process when allocating capital to fixed income funds.

In closing, we believe investors should carefully consider and evaluate the differences between utilizing futures and cash-based bond funds when building their fixed income allocation. Over a period of time, futures-based strategies may indeed yield potential and meaningful tax savings over traditional cash-based bond funds.

Disclosure: Simplify Asset Management and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

[1] 26 U.S. Code § 1256 - Section 1256 contracts marked to market, Internal Revenue Code, https://www.law.cornell.edu/uscode/text/26/1256.

[2] U.S. Treasury index funds represented by: IEI for 3-7 year maturity funds, IEF for 7-10 year maturity funds, TLH for 10-20 year maturity funds, and TLT for 20+ year maturity funds.