Introduction

The modern retirement landscape, characterized by the decline of defined benefit pensions and the shift to self-directed defined contribution plans, has created a fundamental paradox: retirees often possess substantial capital yet may be paralyzed by the psychological and structural challenges of spending it. This inability to transition from saving to spending prevents many from fully enjoying the wealth they spent a lifetime deferring.

In this post, we will explore the five critical behavioral and structural barriers in the decumulation phase of retirement and demonstrate how to design a portfolio that can overcome these hurdles. The final portfolio targets a 10% distribution while simultaneously managing complex longevity, market, and path risks, seeking to empower retirees to confidently unlock and enjoy their lifetime of accumulated savings.

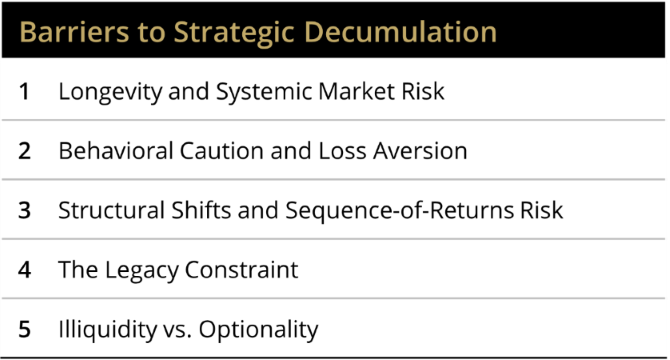

Five Critical Barriers to Strategic Decumulation

Inspired by the "Die with Zero" philosophy, Lifetime Return on Capital (L-ROC)1 measures the effectiveness of capital deployment across a person's entire life, from working years through retirement, to maximize overall happiness, well-being, and experiences. It prioritizes the timing of spending and transfers to ensure the money provides the greatest possible marginal utility, rather than optimizing solely for the largest possible terminal estate or inheritance.

The L-ROC framework allows us to identify five major obstacles (see Figure 1) that prevent retirees from achieving their Maximum Lifetime Utility2. We will now review each obstacle in detail and provide a practical solution using Simplify ETFs.

Figure 1: Five Key Barriers to Strategic Decumulation

Barrier 1: Longevity and Systemic Market Risk

Navigating retirement necessitates the effective management of extended longevity risk against persistent systemic threats, including market dislocation, long-term inflationary pressures, and escalating healthcare costs. This convergence of factors demands an optimized balance between generating substantial cash flow and preserving long-term capital, frequently leading to sub-optimal, overly conservative withdrawal strategies that diminish essential discretionary spending capacity.

Strategic Solution: Seek to generate significant returns while also aiming to be explicitly resilient to the downside.

- Equity Income/Risk Mitigation: The Simplify Barrier Income ETF (SBAR) aims to generate high monthly income by selling put options with a 30% downside “barrier,” where losses only crystallize if the reference indices fall more than that level over the period.

- Higher Equity Income: The Simplify Target 15 Distribution ETF (XV) sells similar barrier put options but with slightly higher barriers seeking to enhance yields.

Barrier 2: Behavioral Caution and Loss Aversion

Decades of disciplined savings can instill deep-seated loss aversion, causing retirees to feel the pain of a market loss far more acutely than the pleasure of a gain. This bias transforms portfolio drawdowns into an emotional event, reinforcing under-consumption and preventing the pursuit of L-ROC during periods of peak vitality.

Strategic Solution: Be sure to have some consistent, safer sources of income.

- Treasury Income: The Simplify Treasury Option Income ETF (BUCK) seeks to offer a high-quality, stable income stream by combining Treasury Bills with a Treasury option writing strategy.

- Enhanced Core Bond: The Simplify Aggregate Bond ETF (AGGH) aims to provide core fixed income exposure augmented with advanced option-writing strategies seeking to optimize yield.

Barrier 3: Structural Shifts and Sequence-of-Returns Risk

The structural lack of guaranteed lifetime income (a la pensions) elevates Sequence-of-Returns Risk3 to the dominant threat during the initial phase of decumulation. A significant market decline that occurs in the first five to ten years of making portfolio withdrawals can permanently derail a portfolio's longevity, as sustained withdrawals compound the loss before the portfolio has a chance to recover.

Strategic Solution: An outcome-oriented portfolio, focused on absolute returns, achieved through uncorrelated income streams and intelligent hedging. To this end, one must consider adding additional income streams that diversify those already outlined above.

- High Yield with Hedging: The Simplify High Yield ETF (CDX) seeks to provide core high yield exposure, with its attractive income, while simultaneously deploying a host of compelling and flexible credit hedge techniques. This fund should nicely diversify the first four funds discussed during a normal market environment, but also has a significant tail risk hedging component that may be accretive in a significant market drawdown, helping to boost diversification even further.

- Alternative Income: The Simplify Currency Strategy ETF (FOXY) seeks to deliver absolute returns with low correlation to equities and bonds by running a carry trade across Emerging Market (EM) and G10 currencies. Allocations across EM and G10 markets evolve as risks evolve, helping create a balanced and diversified exposure.

Barrier 4: The Legacy Constraint

The desire to maximize inheritance can create another behavioral drag, causing retirees to systematically choose lower lifetime fulfillment (under-consumption) to maximize the terminal estate. This spending inertia violates the Die with Zero principle of making timely transfers when the capital's marginal utility is highest for both the donor and the recipient.

Strategic Solution: Seeks to maximize risk-adjusted returns to confidently be able to gift. A diversified portfolio approach, utilizing the diversifying group of ETF solutions outlined so far, is designed to provide strong growth while helping avoid significant losses.

Barrier 5: Illiquidity vs. Optionality

Retirees demand immediate liquidity to fund unforeseen needs (e.g., healthcare) or seize high-value experiential opportunities. Traditional alternatives like annuities and private credit often impose rigid lock-up periods, forfeiting the financial optionality necessary for maximizing L-ROC.

Strategic Solution: Utilize the inherent liquidity and accessibility of the ETF structure to deliver sophisticated strategies with daily liquidity.

The Simplify Target 10% Distribution Portfolio: An L-ROC Framework

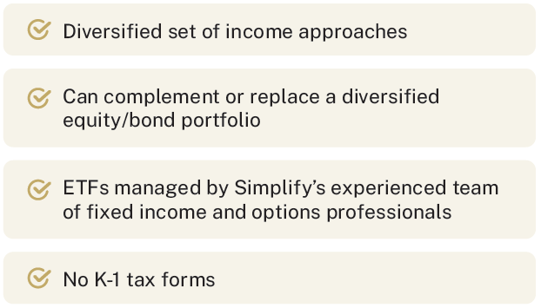

The Simplify Target 10% Distribution Liquid Portfolio offers a definitive and modern solution to the complex decumulation challenge. This robust portfolio is engineered with three powerful components:

- Potential high-income streams with built-in downside risk awareness

- Conservative income solutions to act as the main ballast of a diversified portfolio

- Diversifying income streams that help balance the lower and higher income solutions deployed

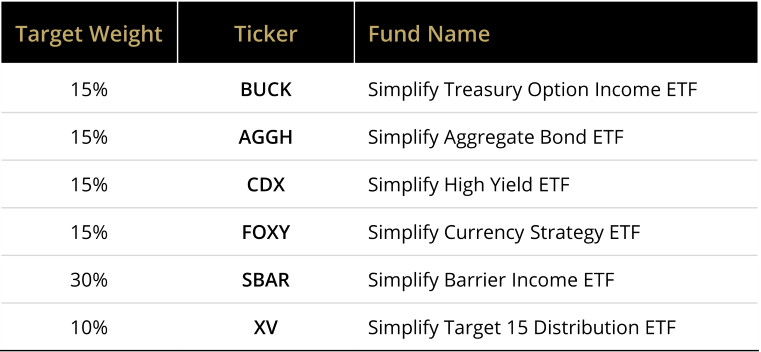

Figure 2 highlights the asset allocation and key highlights of the Simplify Target 10% Distribution Portfolio.

Figure 2: What is Target 10? The Simplify Target 10% Distribution Portfolio

Target Allocation*

Figure 3: Target 10 Objectives

Conclusion

The "Retiree Spending Paradox" is the greatest obstacle to a fulfilled retirement. The Simplify Target 10% Distribution Portfolio provides one solution for overcoming the key barriers to strategic decumulation. By seeking to deliver significant income while actively managing portfolio risk, the portfolio of Simplify’s ETF solutions offers a crucial bridge between financial capital and experiential capital, empowering clients to transition from a mindset of fear to one of confident consumption.

References

1. Perkins, Bill. Die with Zero: Getting All You Can From Your Money and Your Life. Houghton Mifflin Harcourt, 2020. (Concepts: Lifetime Return on Capital (L-ROC))

2. Perkins, Bill. Die with Zero: Getting All You Can From Your Money and Your Life. Houghton Mifflin Harcourt, 2020. (Concepts: Maximum Lifetime Utility)

3. Patel, Kris, CFA. "Retirement Income: Six Strategies." CFA Institute, 2023. (Concepts: Retirement Income Strategies)

GLOSSARY

Barrier Option: A type of customized over-the-counter option in which the underlying reference assets, tenor, and barrier level are negotiated with a counterparty. They set a threshold (“barrier”) below which the underlying notional value is fully exposed to the downside upon expiration.

Lifetime Return on Capital (L-ROC): A conceptual metric, derived from the Die with Zero philosophy, that measures the ultimate success of financial planning by optimizing the individual's net worth.

Loss Aversion: A core concept in behavioral economics that describes the psychological phenomenon where the pain felt from a loss is subjectively about twice as powerful as the pleasure gained from an equivalent gain.

Maximum Lifetime Utility: Refers to the optimal utilization of one's financial resources throughout their entire life—from working years through retirement—to maximize overall happiness, well-being, and experiences. It prioritizes using capital for timely spending and generational transfers (when the money has the highest impact) over maximizing the terminal estate or inheritance.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal number of options are sold at a different strike, all at the same expiry.

Sequence-of-Returns Risk (SoRR): the danger that unfavorable investment returns, particularly large negative returns, occurring early in the retirement (decumulation) phase, will significantly and permanently deplete a portfolio's capital base.